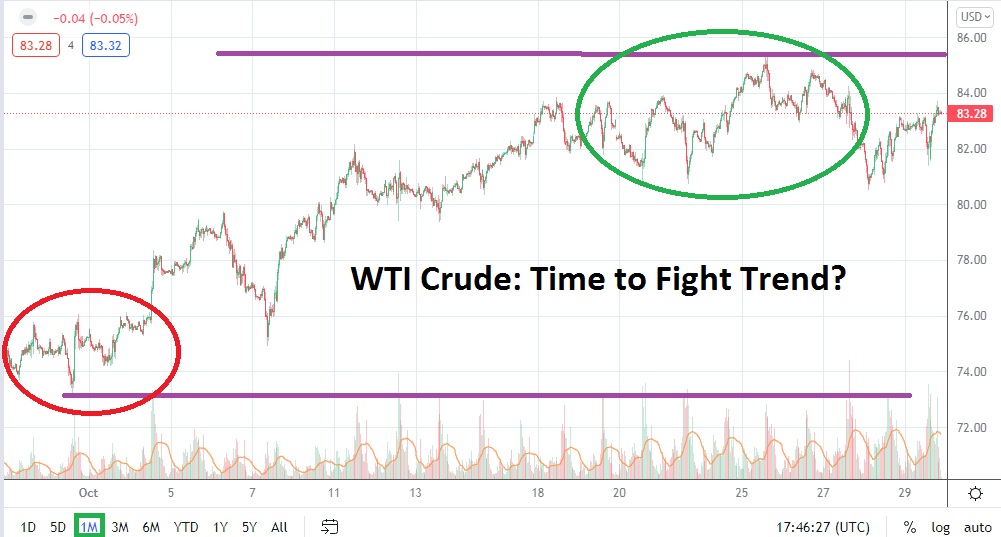

November’s trading of WTI Crude Oil will begin near the 83.00 level and speculators will have important decisions to make regarding their technical and perhaps even fundamental outlooks. Nearly one year ago, WTI Crude Oil was trading near the ‘lofty’ price of 35.00 USD. The more than doubling of value the commodity has achieved in the span of one year is no small feat.

Speculators who have been lucky enough to ride the bullish trend higher may be looking at the current heights of WTI Crude Oil and believe it has been overbought and it is time to change their demeanors. Trades may suspect the trend has been too strong and that a bearish reversal is certain to develop, which will take the commodity lower to a more ‘tranquil’ ratio which takes some luster off the upwards trajectory. On the 1st of October, WTI Crude Oil was trading near the 73.00 price and its gain of 10.00 USD per barrel is more than a ten percent move. Can the commodity sustain its momentum higher?

Contrarians who want to bet against the current heights and seek lower values may believe there is money to be made wagering on moves towards the 80.00 mark which may prove to be a catalyst of support near term. While this may prove to be the case, short sellers should also then turn their attention to long term charts of WTI Crude Oil and see if they have the stomach to withstand the trend upwards which has been rather consistent the past year.

Demand for the commodity has been strong and production questions remain rather tricky as global supply is also sighted as being rather delicate. The additional fact that U.S. producers are not about to be given a green light by the current White House administration to increase the level of drilling and ‘fracking’ should be accounted for and given some credence. While there is plenty of oil for the world to still use, the production and distribution of crude oil is facing a global test according to many reports which has also made buying rather frantic.

While the price of WTI Crude Oil may look overbought to many speculators, the actual value of the commodity doesn’t care about personal feelings of retail traders. The value of WTI Crude Oil may continue to find that demand remains strong and that the potential of reversals lower are limited. Support near the 80.00 mark looks to be intriguing and if the commodity continues to demonstrate ability to stay above this level, the price of 85.00 should be watched carefully. If this slightly higher mark is penetrated and the 86.00 and 87.00 ratios begin to see a challenge, the notion that 90.00 per barrel for WTI Crude Oil could happen is not out of the question.

Coronavirus is still often heard on the lips of many in the media as they speak about economic implications, but the past year of trading shows that demand for WTI Crude Oil is continuing to grow and is needed for a wide array of use. Traders may want to venture a look at very long-term charts. Yes, WTI is at values not seen since 2014, but the price of the commodity has traversed these heights before and wagering on reversals lower simply because the value looks high may prove to be a costly mistake.

WTI Crude Oil Outlook for November

Speculative price range for WTI Crude Oil is 73.00 to 96.00 USD.

If support for WTI Crude Oil falters near the 80.00 mark it could spur on some additional selling which could see a test of the 77.00 to 75.00 marks if the commodity faces a speculative wave of short positions. Strong support for WTI looks to be near the 73.00 and if this is punctured lower towards 70.00 it would be rather surprising in November.

If WTI Crude Oil is able to withstand its current heights and sees sustained buying near 82.00 and 83.00 USD per barrel, traders may believe the 85.00 target could become a quick focus. If October highs are surpassed and the 86.00 and 87.00 levels remains stable when challenged, a move higher to the 90.00 USD juncture is not out of the question for WTI Crude Oil.