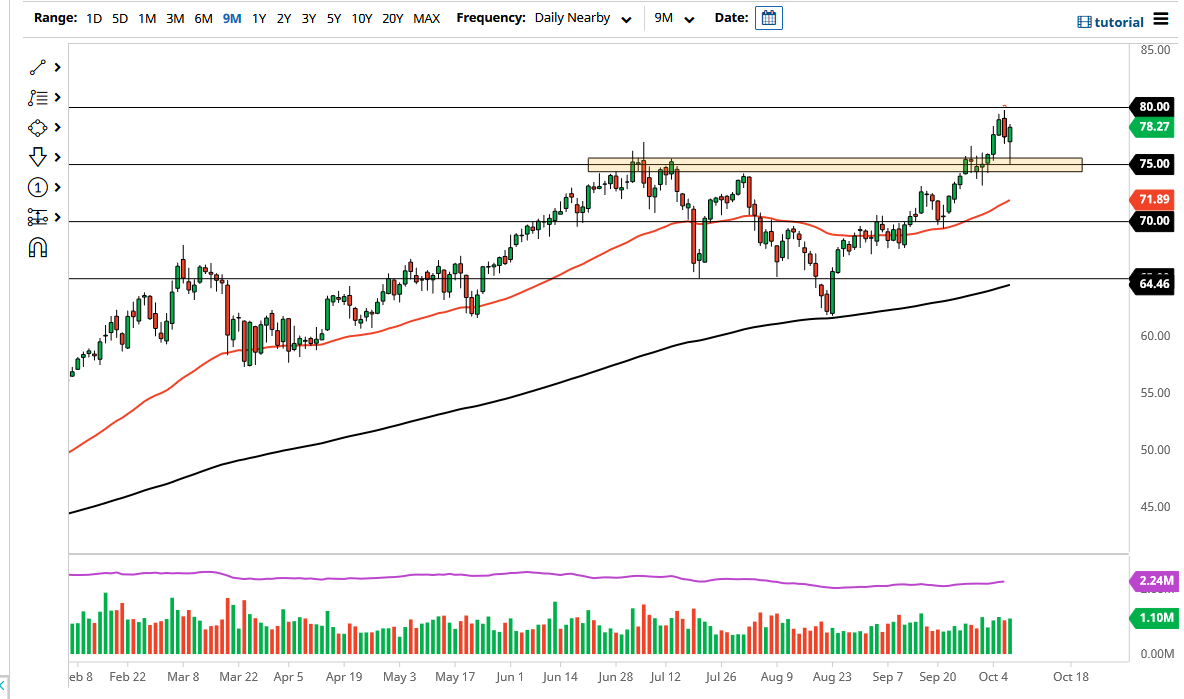

The West Texas Intermediate Crude Oil market has fallen rather significantly during the trading session on Thursday to reach towards the $75 level. The $75 level of course is an area that has been important more than once, and recently offered a bit of a “ceiling in the market.” That being said, the market bouncing from there should not be a huge surprise due to the fact that the market would have a certain amount of memory.

By forming a big hammer, it suggests that the market is going to go higher, perhaps reaching towards the $80 level. The $80 level of course is a large, round, psychologically significant figure, and of course an area that we have pulled back from there. If we can clear that area, then it will open up the next leg higher, which is something that I do expect to see given enough time. Nonetheless, this is a market that I think continues to see a lot of noisy behavior, but there should be plenty of buyers willing to get involved and pick up value.

If we were to somehow break down below the $75 level, then the market could go looking towards the 50 day EMA which is sitting just below the $72 level. The 50 day EMA is grinding higher and should continue to be paid close attention to by traders if we do somehow get some type of major pull back. Nonetheless, this is a market that I think will continue to see a lot of volume and momentum, but quite frankly this is a one-way trade from what I can see. This is especially true now that the United States has noted that it is not opening the Strategic Petroleum Reserve. There was a bit of fear that could be the case, but even when the SPR is released, that tends to be a very short-term negative to the market and has less and less efficacy. In other words, I do not know that there is anything that can stop the assent of crude oil anytime soon, so the only thing you can do is look for little bits of value to take advantage of on short-term charts, unless of course you are willing to hang onto the market for a longer-term move towards $90.