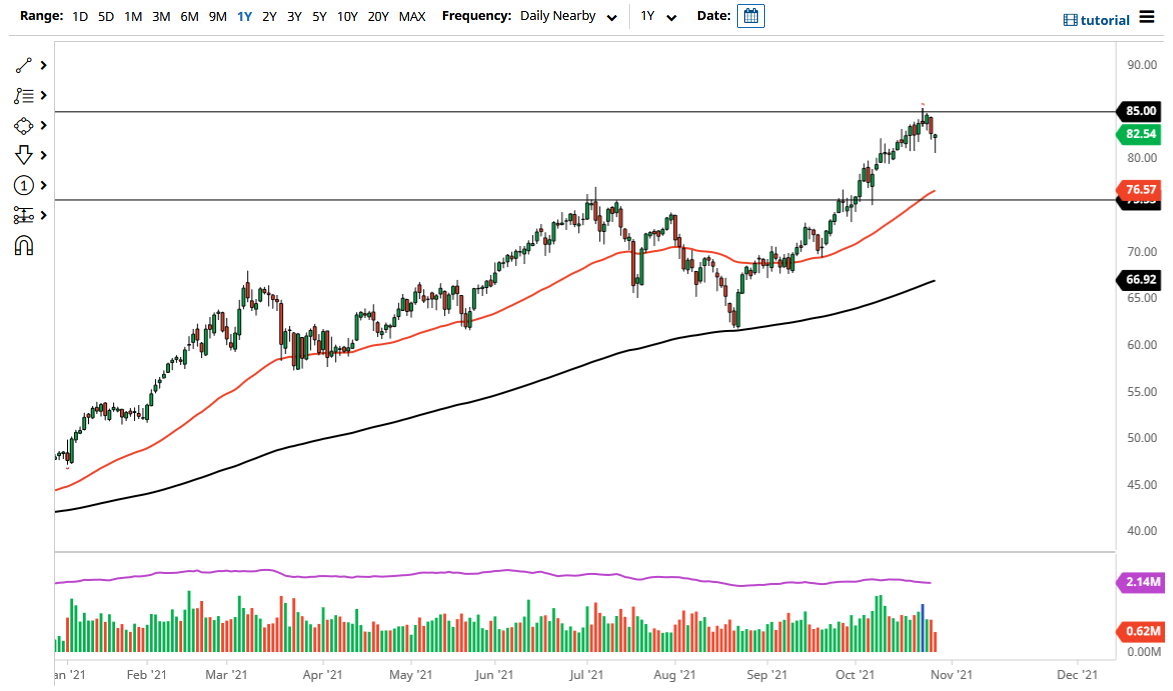

The West Texas Intermediate Crude Oil market has fallen rather hard to kick off the trading session on Thursday, but as you can see, we have rallied quite drastically to recapture the $82.50 region. By doing so, we ended up forming a bit of a hammer, which of course is a bullish sign. By doing so, I do think that it is only a matter of time before we continue to go higher. After all, we are in a very strong uptrend and that has not changed, despite the fact that we have pulled back over the last couple of days.

Looking at this chart, the $80 level underneath is significant support, as it is a large, round, psychologically significant figure. The $80 level underneath has been important more than once, so therefore I think we will continue to pay close attention to it. At this point, I like the idea of picking up bits and pieces of value on dips, as the crude oil market has been so heavily influenced by the reopening trade and of course the fact that we are looking very likely to continue to see demand pick up due to the fact that there was so little in the way of capital expenditure over the last several months, and of course there has been an increase in burn rate. Furthermore, other forms of energy have failed miserably, and therefore power plants are being forced to burn petroleum as well. With the noisy behavior, I think it is only a matter of time before we see this market go looking towards the $85 level. The $85 level is a large, round, psychologically significant figure, and one that will be a target. If we can break above there, then it is likely that this market takes out to the upside.

Underneath, the $80 level should offer quite a bit of psychological and structural support, so that being said it is likely that we will see plenty of buyers in that area. The 50 day EMA currently sits just above the $75 level, and it does suggest a certain amount of resiliency and could be the “floor the market” going forward. Regardless, this is a longer-term uptrend, and we cannot fight it. Energy demand will continue to be very strong going forward, and therefore we should continue towards $90 over the longer term.