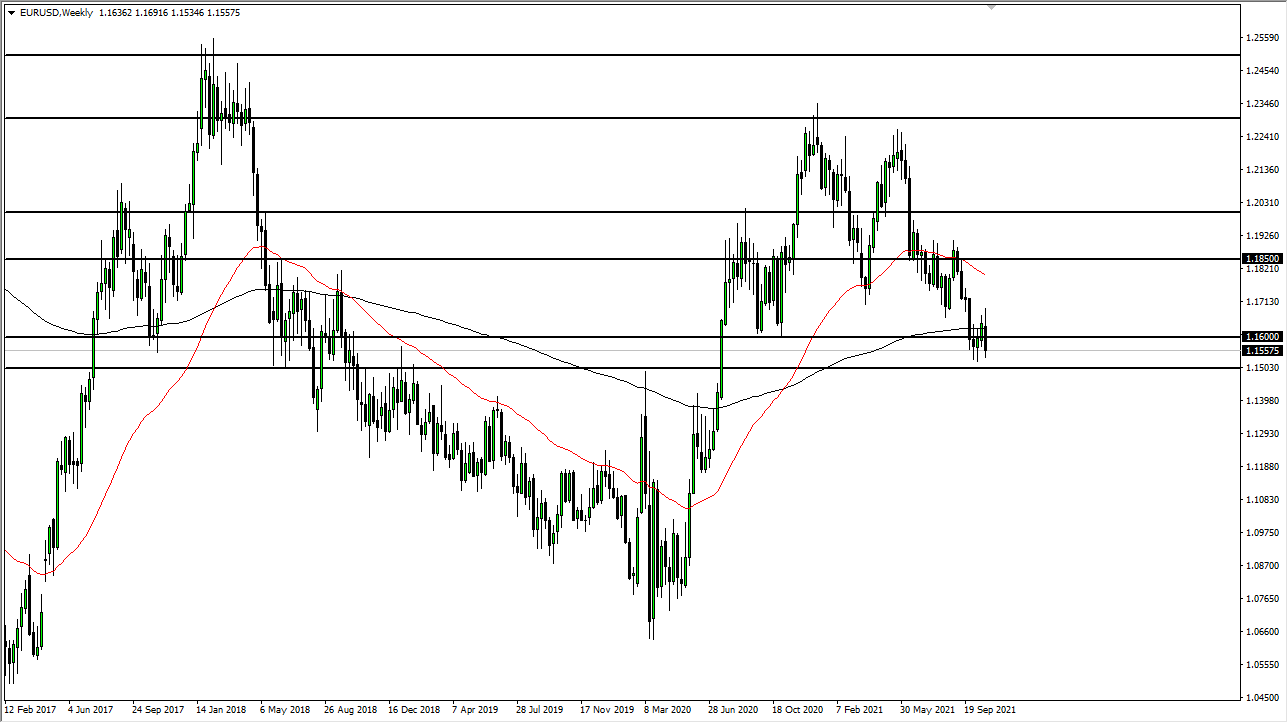

EUR/USD

The euro fell drastically during the Friday session to wipe out all of the gains from the previous week. That being said, keep an eye on the 1.15 handle, because it is going to be crucial in keeping this market in a uptrend type of move. If the market were to break down below the 1.15 handle, then the euro more than likely will drop a couple of handles. On the other hand, and the of scenarios in my estimation, we may turn around and rally to simply bounce around in this support level yet again. The key to this pair is going to be whether or not the US dollar strengthens again.

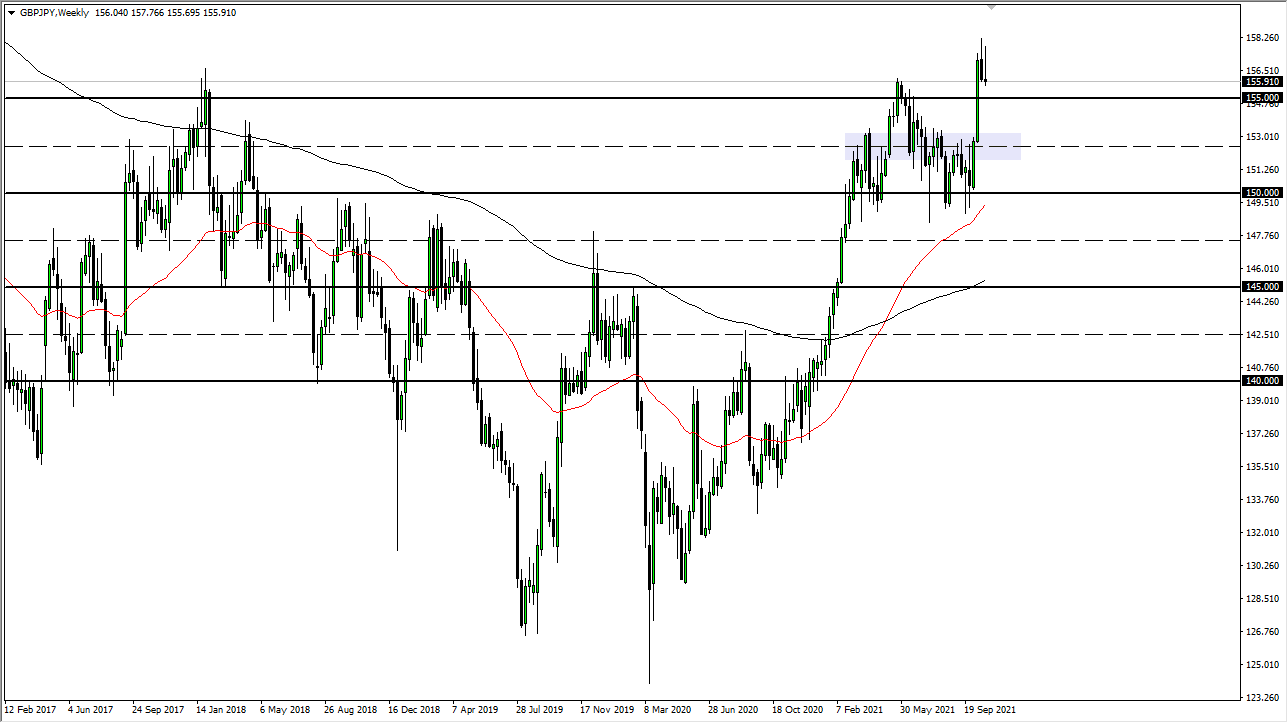

GBP/JPY

The British pound has initially tried to rally but ended up forming a bit of a shooting star. That being said, the ¥155 level underneath should offer a significant amount of support as it was previous resistance. So-called “market memory” comes into the picture, and even if we break down below there, I think that the market probably will go looking towards the ¥153.50 level. The market is still very much in an uptrend, but we may need a little bit of a pullback in order to pick up the necessary momentum to continue going higher. At this juncture, the Japanese yen is most certainly oversold.

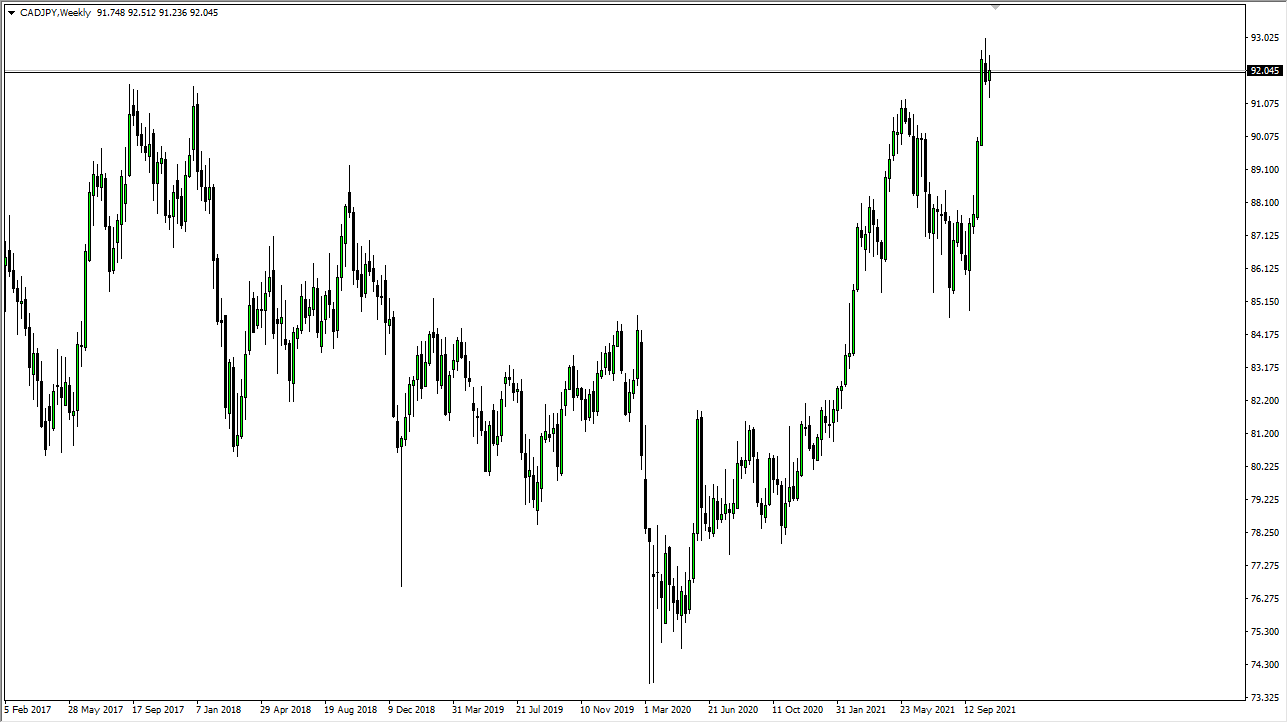

CAD/JPY

The Canadian dollar went back and forth over last week as we continue to hang about the ¥92 level. The market will follow oil, as it typically does over the longer term. For what it is worth, the oil market looks as if it is ready to go higher, so it will be interesting to see how this plays out. The Bank of Canada has also suggested during last week that an interest rate hike is coming much sooner than anticipated, and that could continue to favor the Loonie over the Japanese yen.

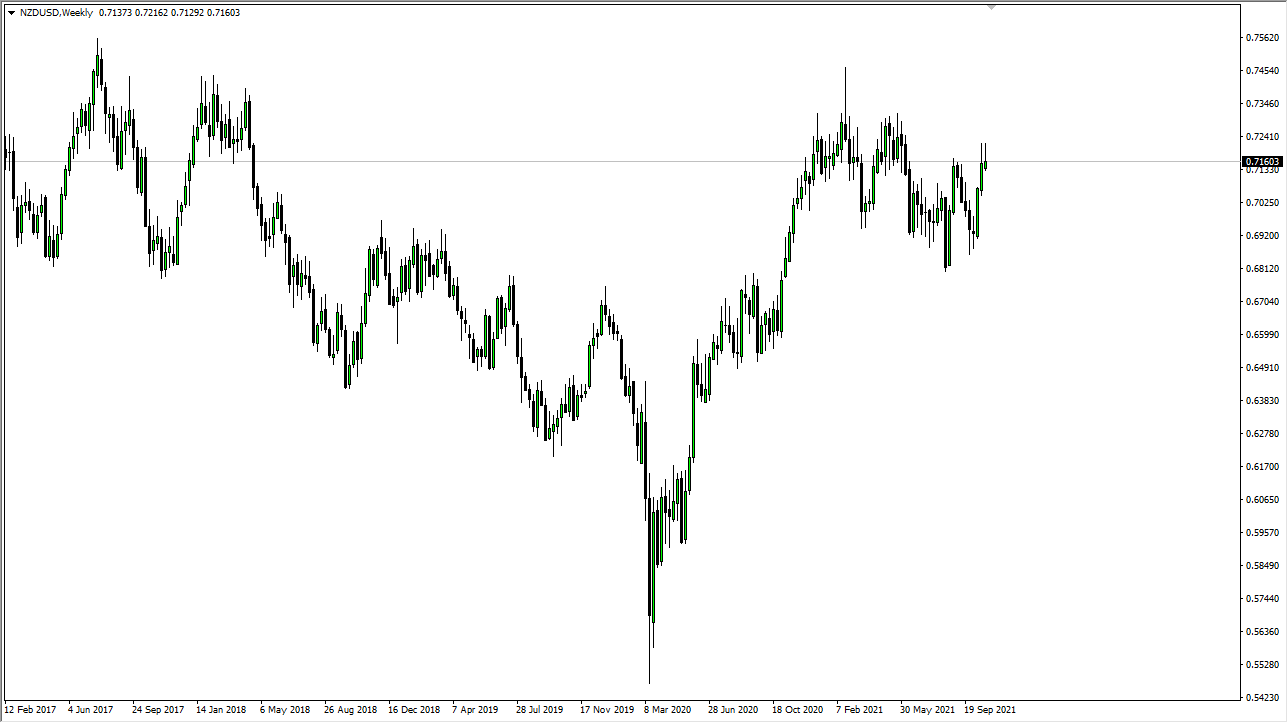

NZD/USD

The New Zealand dollar initially tried to rally during the week, but it sees plenty of resistance just above at the 0.7233 region. At this point in time, if we can break above there, then it is likely that the New Zealand dollar could go looking towards the 0.73 handle. A breakdown below the bottom of the weekly candlestick has this market looking for support at lower levels, and I would be especially interested in the New Zealand dollar near the 0.70 level.