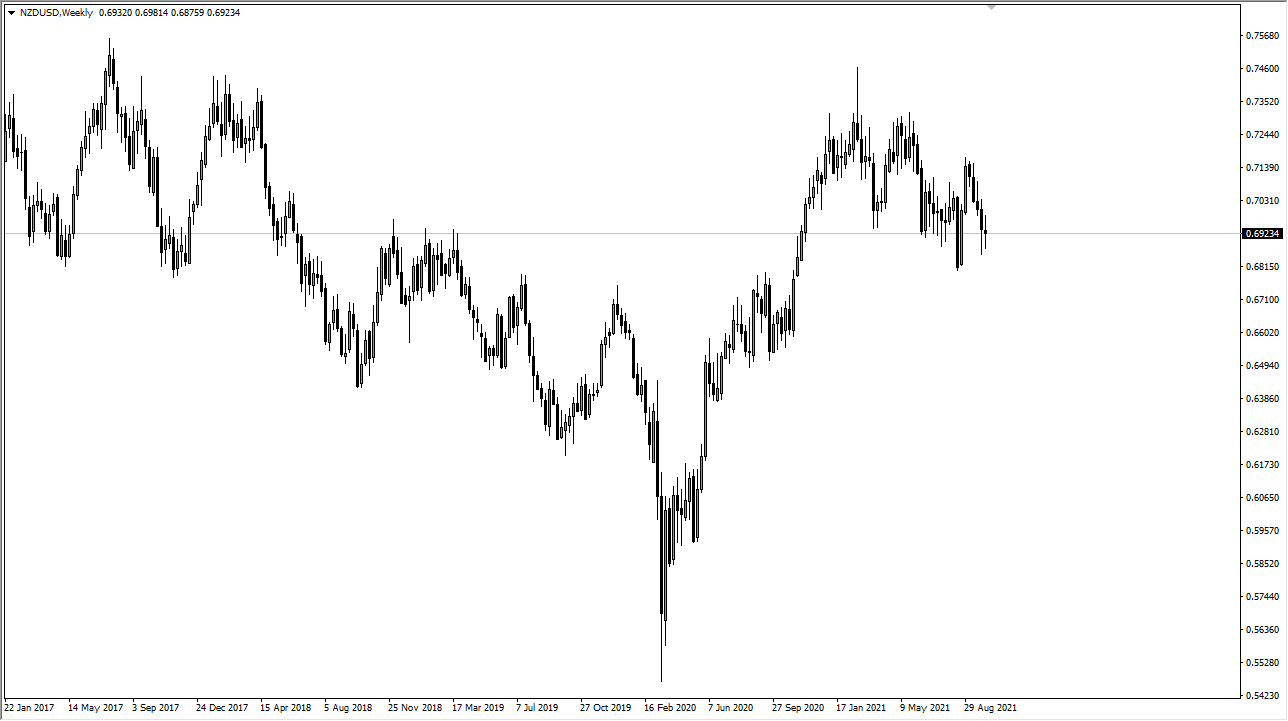

NZD/USD

The New Zealand dollar has been all over the place during the week, even as the Royal Bank of New Zealand has raised rates. The New Zealand economy is far too attached to Asia to think that it is simply going to take off to the upside. The market is showing signs of confusion, and I think at this point if we break down below the 0.68 handle, this market could unwind. On the other hand, move above the 0.70 level, then it is very likely that we go higher.

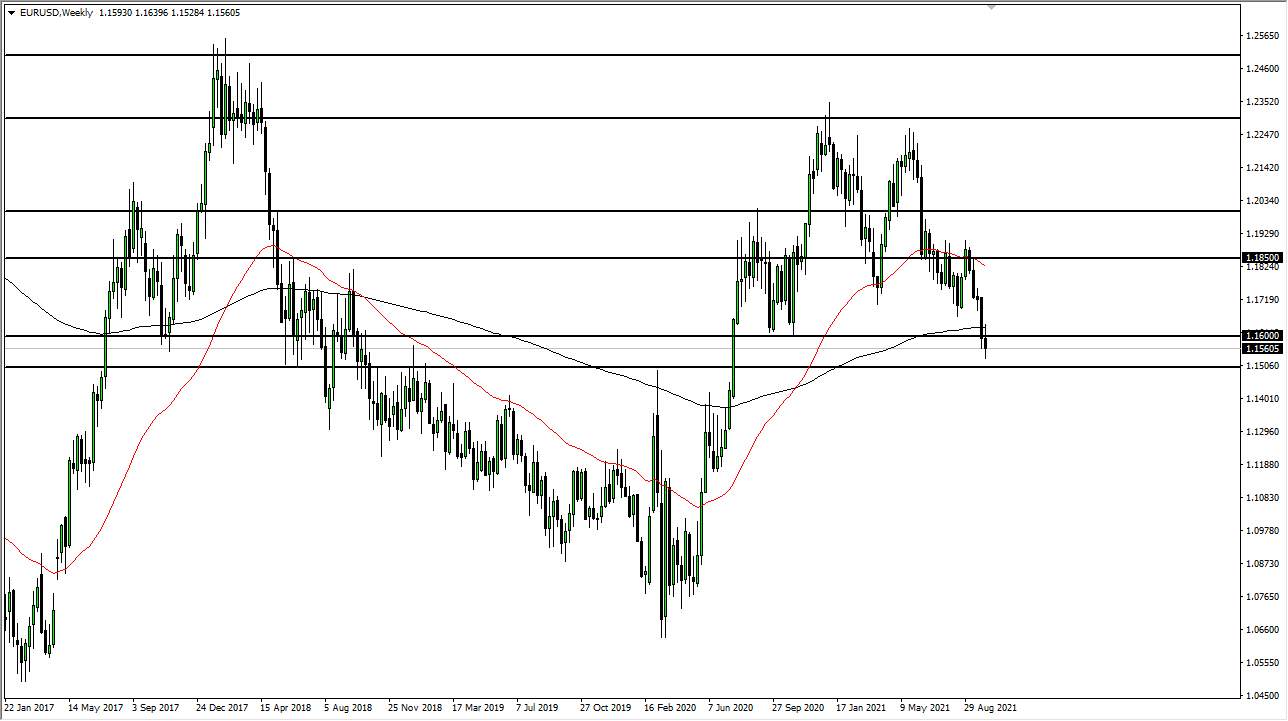

EUR/USD

The euro was relatively negative last week, as we are trying to chew through the support region that sits between the 1.16 level and the 1.15 level. If we break down below the 1.15 level, it is very likely that this market would go lower, perhaps reaching as low as 1.1250. On the other hand, if we can take out the top of the previous weekly candlestick, then we could make a move towards 1.1850 level but that would take at the very least a daily close above the 1.1750 level to make that a palatable trade.

As the Federal Reserve is likely to start tapering sometime later this year, it is very likely that the pair will continue to see downward pressure due to the fact that the ECB is only expanding its balance sheet at this point, and the EU is having trouble even powering itself.

NZD/JPY

The New Zealand dollar rallied significantly last week, with ¥78 above offering resistance, right along with the ¥79 level after that. To the downside, the ¥77 level has offered little bit of support, and the 50-week EMA is starting to reach towards that area. This is a market that I think will continue to be very noisy and choppy, and I would anticipate more back-and-forth action due to the fact that there is so much concern around the world as far as growth is concerned, and this is a very risk-sensitive pair.

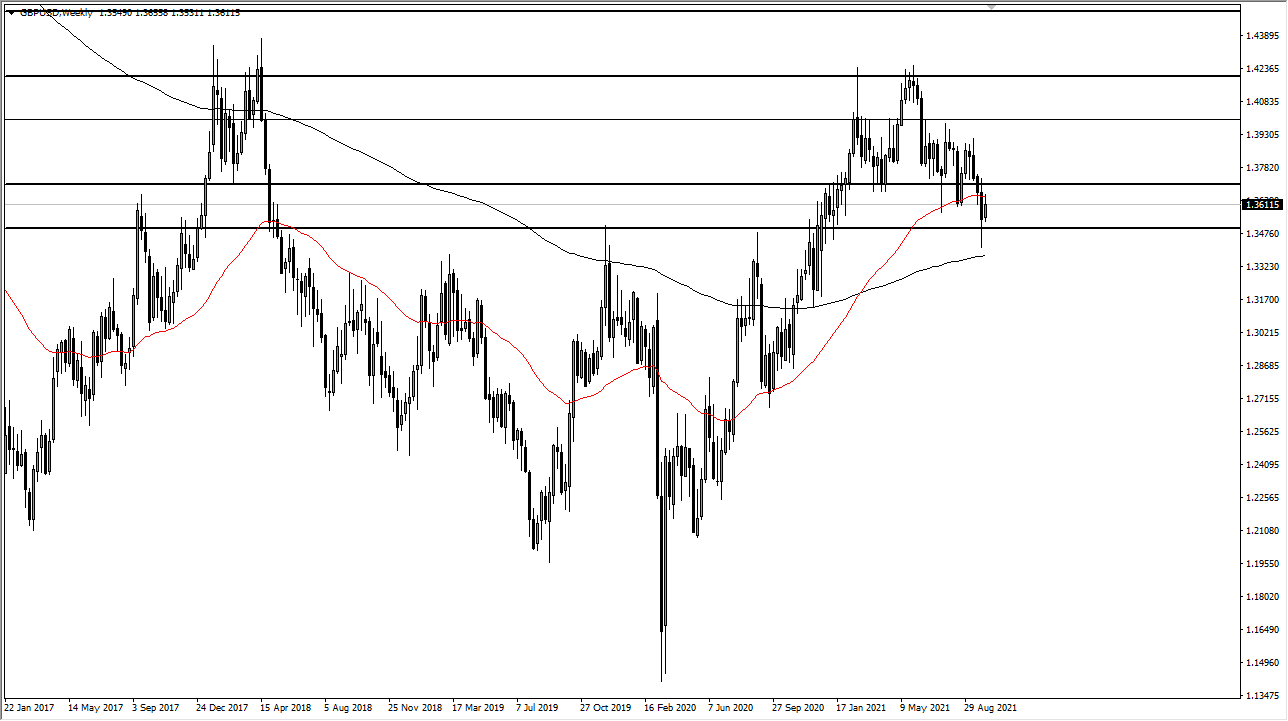

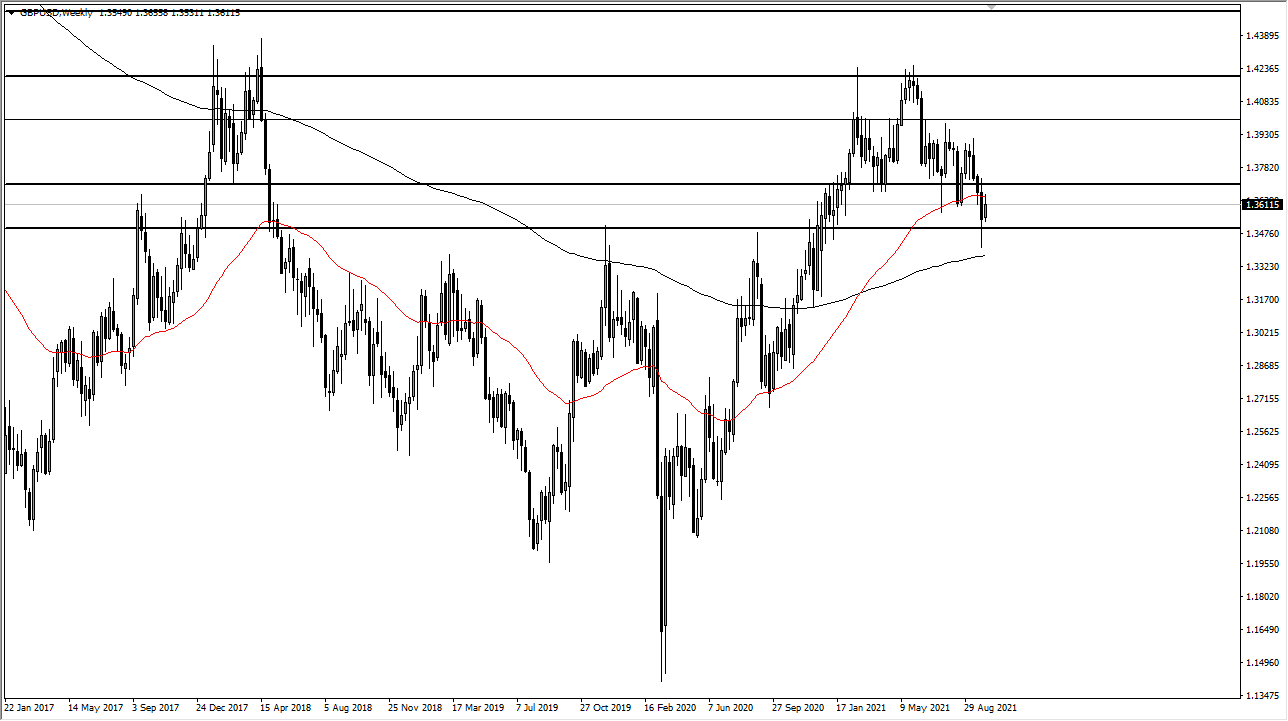

GBP/USD

The British pound rallied during the week but turned around at the 50-week EMA to show signs of hesitation again. If we can break down below the 1.35 handle, it is very likely that this market will go much lower, perhaps reaching towards the 200-week EMA. On the other hand, if the market were to turn around and break above the 1.37 level, then it is possible we may go looking towards 1.39.