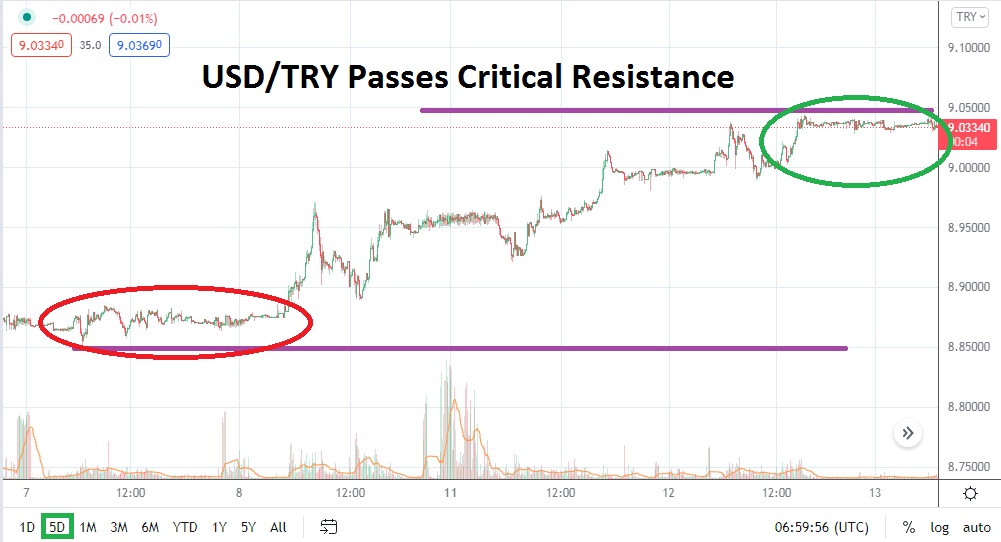

The USD/TRY has penetrated the 9.0000 level in an upwards push which has the Forex pair exploring uncharted record highs. Bullish momentum has been strong the past month and it has generated more power since the 1st of October when the USD/TRY was trading near 8.82000. Yesterday saw the 9.00000 value surpassed and instead of setting off a massive reversal lower, the USD/TRY has actually shown stability and sustained it record heights which can be perceived as bullish activity to come.

Technically trying to estimate just how high the USD/TRY can go is a dangerous game. Logically, if the 9.05000 proves vulnerable and prices are maintained above this level, speculators could not be blamed for believing higher ratios could soon be challenged. The combination of the ever-present nervous sentiment regarding the manner the Turkish government tries to manipulate its central bank, has also likely been effected by whispers in the media about the possibility of increased military actions by Turkey within its region. The added fact the USD has been legitimately strong against many major currencies the past couple of weeks has not helped the Turkish lira either.

Speculators who believe the USD/TRY has been overbought and that a reversal lower will occur should keep their eyes on the 9.00000 ratio, but the mark below near 8.98000 could prove to be more significant. If the USD/TRY is able to challenge support around this lower level it could produce another leg down towards 8.92000 to 8.89000. However, traders who do decide to pursue downside price action need to have all of their risk-taking tools working to protect additional moves higher.

While it might be tempting to believe a ‘definite’ reversal needs to happen within the USD/TRY, the overwhelming piece of evidence short term is a demonstrative trend upwards. Even if the USD/TRY is able to display a slight move lower, it may be a rather intriguing signal for speculative bulls to buy the pair and look for another leg higher. Until the USD/TRY is able to legitimately sell off and trade below the 8.82000 ratio again, the trend near term can be looked at technically as bullish. Buying the USD/TRY for conservative traders near the 9.01000 to 8.98000 and looking for reversals higher may be the worthwhile wager.

Turkish Lira Short-Term Outlook

Current Resistance: 9.06000

Current Support: 8.98000

High Target: 9.11200

Low Target: 8.89100