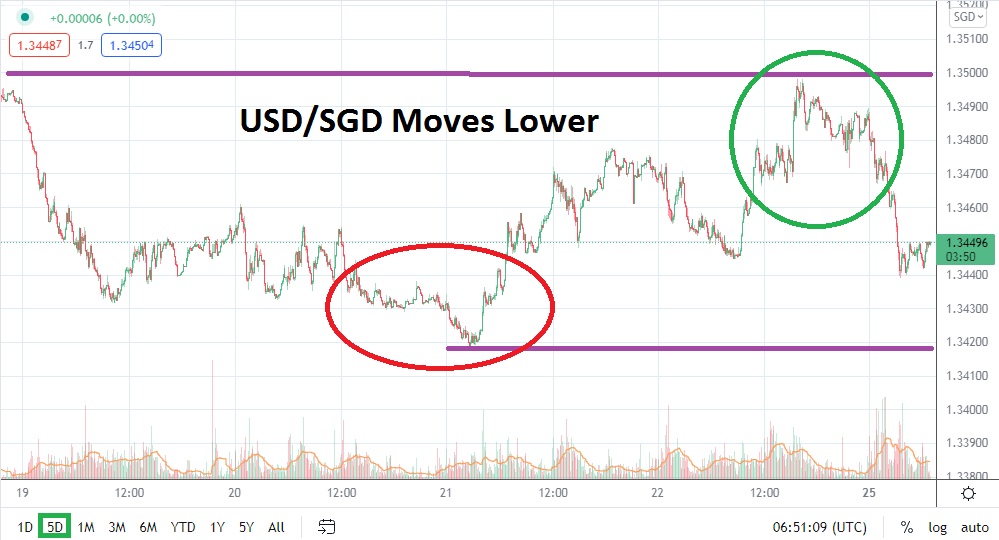

After reaching a high of nearly 1.36340 in late September and coming within sight of values seen in the third week of August, the USD/SGD has actually demonstrated a bearish trend. As of this writing, the USD/SGD is near the 1.34440 level and appears to be under selling pressure. Before going into the weekend, the Forex pair did slip to a low of approximately 1.34420 and today’s trading is certainly testing this lower mark.

Intriguingly on Thursday of last week, the USD/SGD moved to a low of nearly 1.34170, but did reverse higher when the pair came within sight of values last traded in a sincere manner on the 15th of September. What may spark the interest of speculators is that the reversal higher, which was ignited on Friday before going into the weekend, approached the 1.35000 juncture without being hit and fizzled. Buyers seemed to run out of momentum and strong selling has ensued.

Current support levels near the 1.34400 level are clearly important for the USD/SGD, and if this ratio proves vulnerable, the next road sign that may be targeted rather quickly is the 1.34380 vicinity. If this relatively close support barrier is penetrated lower, it could signal additional selling pressure may develop which could begin to mount a challenge to last week’s lows.

The USD/SGD has provided a full summer’s worth of choppiness and trading this fall has also proven rather volatile, but the Forex pair does offer technical traders rather prolific trending opportunities. If a long-term chart is looked at, there seems to be evidence that the 1.34000 juncture could prove to be a vital target for speculators who believe the trajectory of the USD/SGD will maintain its momentum downward. However, for that to happen in the near term, support levels will need to prove inadequate.

Cautious speculators may want to remain sellers of the USD/SGD and pursue its bearish path. Traders may want to wait for slight moves higher, but if the 1.34440 level is maintained and does not show any real movements higher which are sustained, this could prove to be enough of a selling indicator. Wagering on support levels to be hit with solid take-profit orders working may be a worthwhile near-term endeavor.

Singapore Dollar Short-Term Outlook

Current Resistance: 1.34620

Current Support: 1.34380

High Target: 1.34800

Low Target: 1.34060