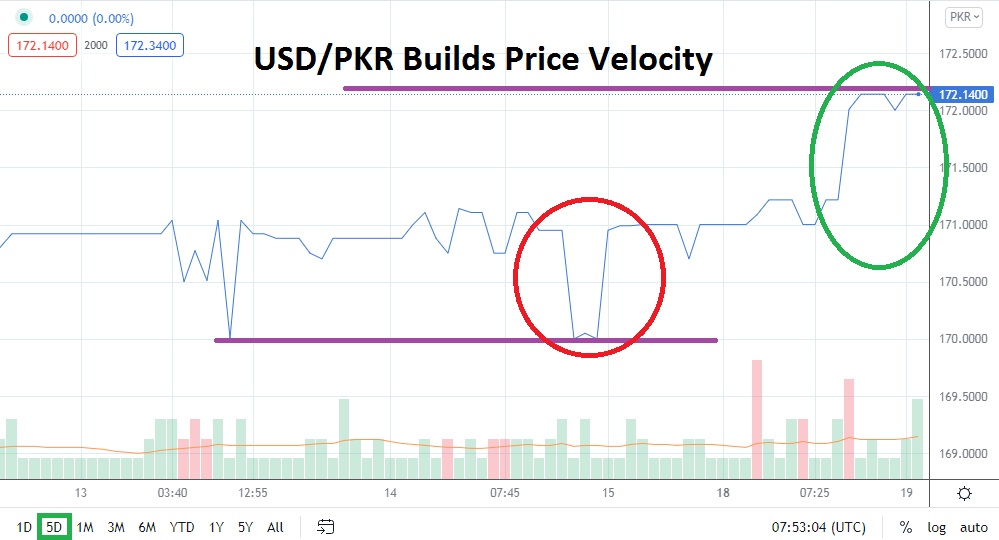

The USD/PKR is trading above 172.0000 as of this writing, and the possibility that speculative elements are now having an effect on the Forex pair as technical weakness is being demonstrated is likely as financial institutions grow nervous. The USD/PKR went from an approximate low of 170.9900 yesterday to a high of 172.1400, where the pair is now traversing.

On the 20th of September, the USD/PKR was essentially trading near the 167.5000 mark and has experienced a sincere bullish move higher. If a three-month chart is entertained by traders, they will see the USD/PKR was trading near the 159.8000 ratio on the 19th of July.

Speculators who are looking for the USD/PKR to suddenly reverse lower should not be looking for large moves and they should have their take-profit orders working to get out of the market when their targets have been hit. Yes, the USD/PKR was trading near the 171.0000 mark on the 6th of October and then was trading near 170.0000 on the 14th, but these minor reversals lower are frequently hit by more robust moves higher which ultimately creates a new record high, this happened yesterday.

Resistance for the USD/PKR currently seems to be the 172.2000 mark. As always, traders who decide to pursue the Pakistani rupee must take into consideration the costs of transactions when wagering on the USD/PKR. Because the trend is rather strong in one direction, one of the stumbling blocks for traders may be due a higher transaction cost for trading the Forex pair.

Overnight fees for carrying charges and the fact that the spread is big in the USD/PKR make it sometimes difficult to get out of a position when needed. Meaning, if you are holding a USD/PKR and need to suddenly get out of the position for a reason that can be one of many, that your price fill may suffer because the spread between the bid and ask in the pair is not where you want it to be and can prove costly.

Buying the USD/PKR remains the go to plan for wagering on the pair. The use of careful leverage should be practiced; entry orders should have an exact price they desire to be executed. Support for the USD/PKR short term appears to be the 171.9000 area. If this ratio is sustained, higher moves may develop and new record highs may be attained near term.

Pakistani Rupee Short-Term Outlook

Current Resistance: 172.2000

Current Support: 171.9000

High Target: 172.5000

Low Target: 171.1600