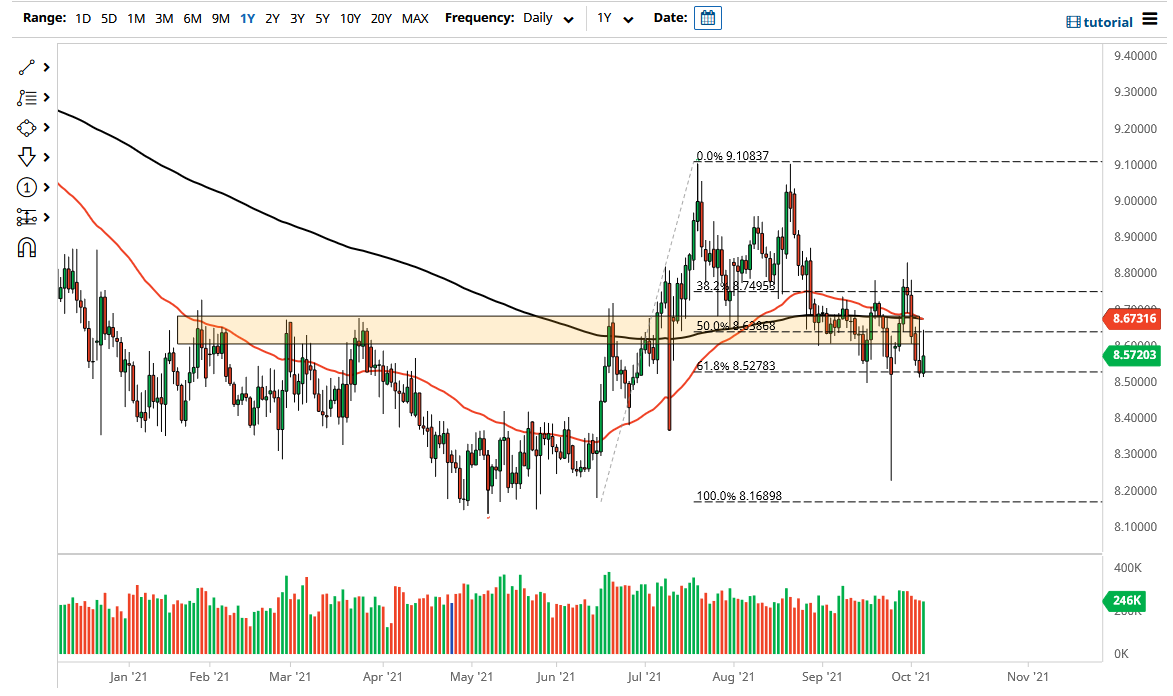

The Norwegian krone is currently hovering around 8.75 against the greenback, after initially trying to rally on Wednesday. You can see that the candlestick on Tuesday also did the same thing, pulling back from the 50-day EMA. The 50-day EMA is starting to grind below the 200-day EMA, forming the so-called “death cross.” Having said that, given that we had been so flat on the moving averages heading into that indication, I would not put too much faith in that indication.

If we were to break down below the bottom of the candlesticks from the last couple of days, it is likely that the market will then challenge the 8.5 level, which could open up a move to much lower pricing. You can see that there was a wicked hammer from two weeks ago that reaches all the way down to the .25 handle, and that would be my target if we do in fact get the breakdown. The inverted hammers are very bearish signs, so that would attract a lot of attention if it does in fact kick off lower.

On the other hand, if we were to turn around and break above the 200-day EMA, and by extension break above the top of the inverted hammers, we will initially go looking towards the .75 level, and then eventually the 9.05 level after that. The Norwegian krone typically will move right along with oil, but we have not seen as much of that recently. This could be an issue when it comes to where we go next, especially as interest rates in the United States have been climbing. The question now is whether or not we are going to pay attention to crude oil more than we are yields. Get that question right, and then you will get the trade right. At this point, we have a couple of areas where we can place orders as mentioned previously. The next couple of days could be rather noisy as we head towards the jobs figure, which also has a major influence on the oil markets. As energy demand continues to skyrocket in the European Union, Norway may be one place where we see strength as a result over the longer term.