The Japanese yen continued its decline against the other major currencies, amid hopes of a wider divergence in interest rates between the US and Japan. While the Fed plans to scale back its asset purchases amid rising inflation, the Bank of Japan is unlikely to move towards policy normalization soon. The rising US Treasury yields are widening the interest gap with their Japanese counterpart, causing the yen to fall. The USD/JPY therefore rushed towards the 113.41 resistance, its highest in three years, and settled around the 113.25 level as of this writing.

The Japanese yen was also affected by higher oil prices due to supply constraints and continued strong demand. Comments by new Japanese Prime Minister Fumio Kishida that he will not raise the capital gains tax in the country for the time being, boosted sentiment further. The prime minister has confirmed that the Japanese government is focusing on raising wages before the capital gains tax review.

Investors are looking forward to the start of the company's earnings release this week. Analysts said the latest round of corporate results may help give the market more direction after several volatile weeks. US stocks swing between gains and losses as investors try to better gauge the direction of the economic recovery over the rest of the year. Banks will be among the first major companies to announce their latest financial results and give investors more insight into how companies are doing amid fears of the virus pandemic and rising inflation.

JPMorgan Chase will present its results on Wednesday. Bank of America, Wells Fargo and Citigroup will announce results on Thursday.

Delta Air Lines will announce its latest results on Wednesday. The airline industry is still struggling to recover from the pandemic lockdowns that began 18 months ago. Investors will be closely watching industry results to see how much of an impact the summer surge of COVID-19 cases has had on the industry.

Investors are also looking forward to this week's economic data which may shed more light on what is happening with inflation. The Labor Department will release the US Consumer Price Index on Wednesday and the Producer Price Index on Thursday. The reports will detail the pressure caused by inflation on consumers and businesses.

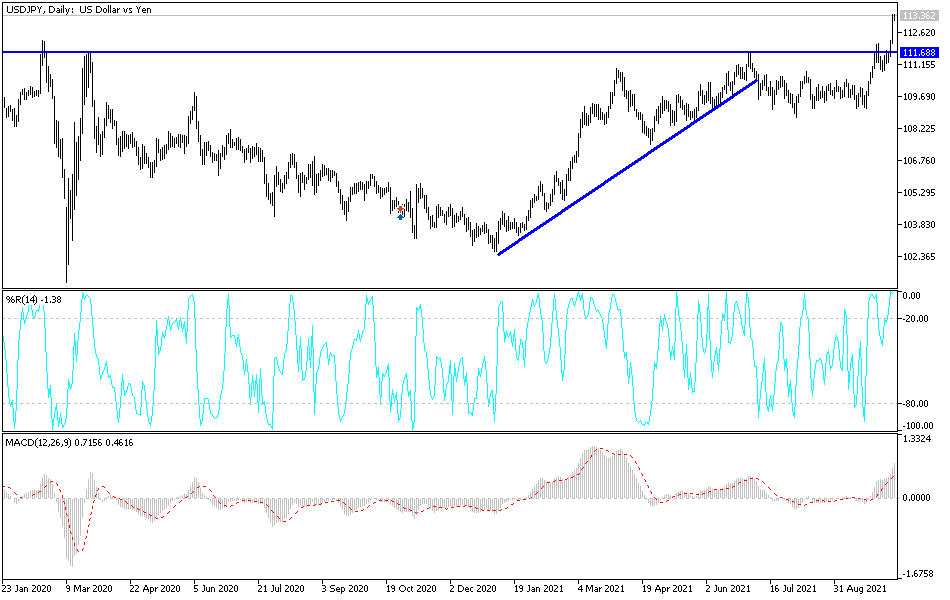

Technical analysis of the pair

On the daily chart, the recent gains of the USD/JPY were enough to push the technical indicators to overbought levels, and unless the dollar goes higher, we may witness profit-taking soon. Currently, the closest targets for the bulls are 113.55, 114.20 and 115.00. On the downside, there will be no shift in the general bullish trend now unless the currency pair breaches the 110.00 level again. The gains of the USD/JPY are contingent this week on the announcement of US inflation figures and the reaction to the minutes of the last meeting of the US Federal Reserve.