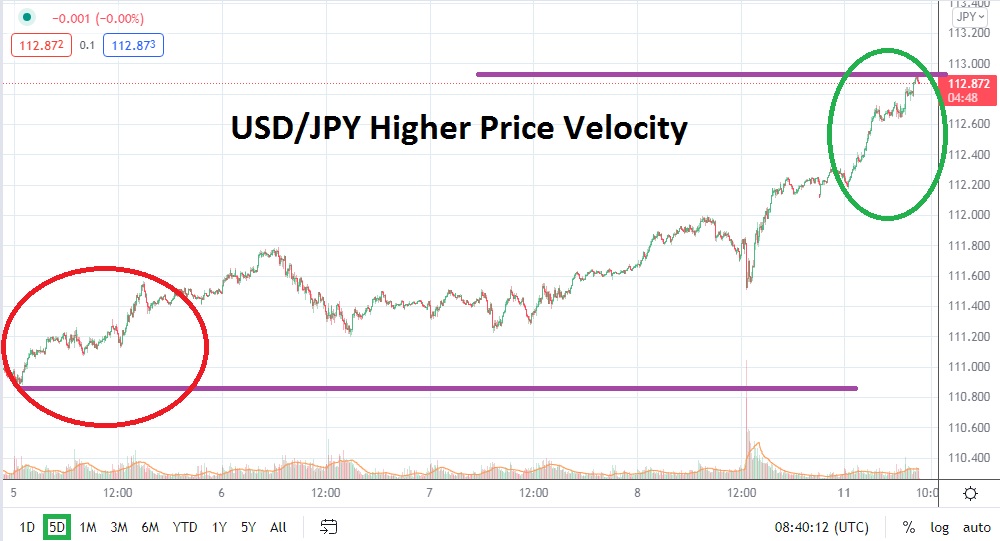

The USD/JPY is trading within sight of the 113.000, which is a height the Forex pair has not traversed since December of 2018. Short-term traders pursuing upside momentum may want to pull out long-term charts to gauge the heights the USD/JPY has been able to climb before. The past few days of trading in the USD/JPY have also produced fasting trading conditions as upwards momentum has certainly increased.

On the 7th of October, the USD/JPY was trading near the 111.200 mark which had tested lows essentially made the day before. However, these ‘lows’ actually remained in the upper price band of one-month charts and the USD/JPY has continued to produce a bullish move which has brushed aside resistance levels with ease. As late as the 8th of October, after still climbing, the pair reversed slightly lower to nearly 111.500, but since producing this ‘low’ price velocity has jumped.

The absence of US financial houses because of the American holiday today may produce the opportunity for greater volatility short term. Traders should be aware that fast conditions and the climb upwards demonstrated in early transactions today should be perceived as potentially ‘too fast a move’, but the trend higher in the USD/JPY is not a sudden development. On the 15th of September, the USD/JPY was trading slightly above the 109.000 juncture.

Technically, after the USD/JPY penetrated through resistance of 111.000, the Forex pair has certainly seen increased buying. Essentially, after surpassing highs seen on the 2nd of July near the 111.680 juncture, the USD/JPY has not had many roadblocks and has soared upwards. The question speculators need to ask is how far the USD/JPY gains can be extended. While long-term charts may attract speculators, short-term considerations must be kept rational.

Traders should not get overly ambitious and they must remember that today’s price action lacks US investors. However, the trend higher has been strong and the 113.000 juncture may entice plenty of speculators and may also have programmed trading ready to ignite. If the 113.000 can be surpassed and sustained, trader may believe the 113.100 to 113.250 marks are legitimate targets for quick-hitting trades. Volatility may appear near term based on the current price levels and speculators are advised to use proper risk management.

USD/JPY Short-Term Outlook

Current Resistance: 113.000

Current Support: 112.600

High Target: 113.250

Low Target: 111.950