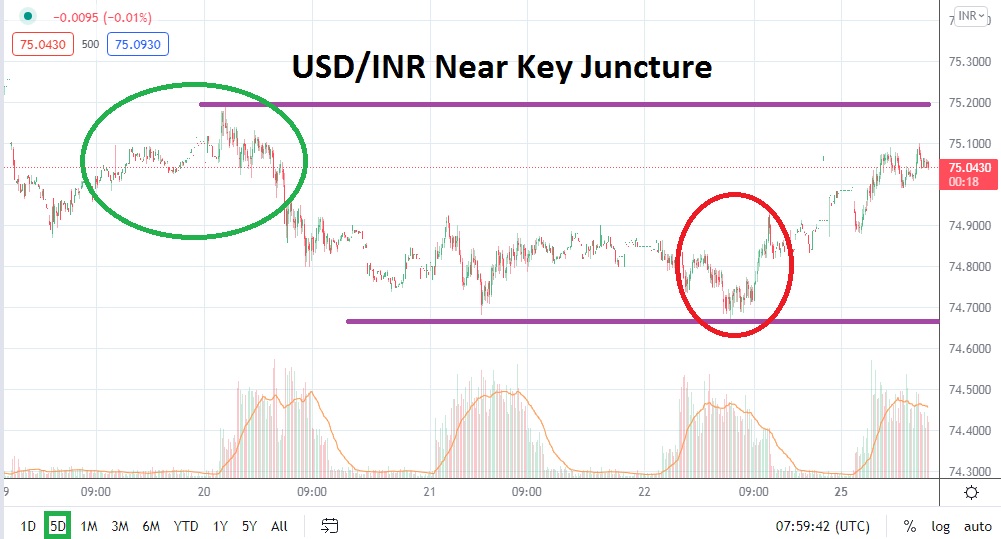

As of this writing, the USD/INR is hovering near the 75.0000 juncture, and in early trading this morning, the Forex pair did move to a low of nearly 74.8700 which then sparked a reversal higher. Before going into the weekend, the USD/INR did trade near the 74.6500 ratio, but did begin to see some bullish momentum develop. Friday’s low did challenge values not seen since the first week of October.

Technical traders who look at one- and three-month charts of the USD/INR will quickly come to the conclusion the pair remains within the upper realms of its value range. The 75.0000 price now being challenged could prove to be an important psychological battle. Some speculators may view anything above this ratio as an indication that the Forex pair has been overbought.

Certainly since reaching a high on the 12th of October, which touched April’s apex, the Forex pair has seen some incremental selling. Volatility remains a potential nemesis within the USD/INR for traders, and conservative market participants may want to see greater momentum develop in a particular direction before trying to pursue a trend. Current support near the 74.9400 price is relatively close and, if this level begins to see a test, it may indicate further selling is going to ensue.

More aggressive traders may look at the 74.9700 to 74.9400 junctures as logical places to place take-profit orders if they sell the USD/INR within its current price ratio. From a risk reward viewpoint, there is reason to suspect near term that the USD/INR has the potential to find a more robust downward trajectory compared to an upwards movement. Yes, the USD/INR remains within its higher technical range long term, but speculators may be enticed to believe there isn’t much more ground to attain higher.

Traders should remain cautious within the USD/INR and use stop loss orders carefully. However, the rather technically evident support and resistance levels being demonstrated may make the pair an attractive wager short term. Selling the USD/INR and looking for more bearish momentum to be demonstrated could prove to be an interesting position. Traders who are lucky enough to have profitable trades should not become overly ambitious in the short term.

Indian Rupee Short-Term Outlook:

Current Resistance: 75.1030

Current Support: 74.9400

High Target: 75.1860

Low Target: 74.7800