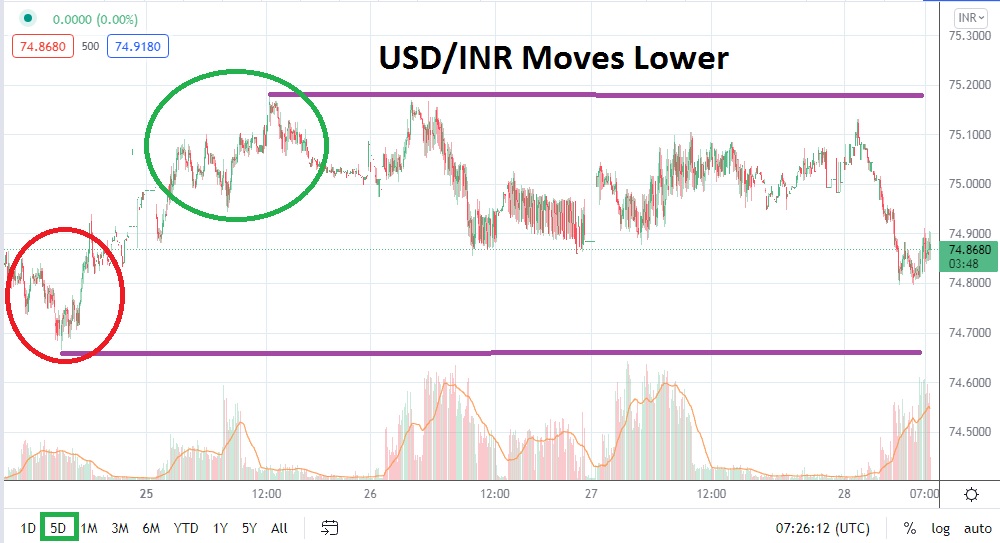

The 74.9000 level has been broken lower in early trading today by the USD/INR which continues to demonstrate an ability to incrementally move in a bearish direction. The USD/INR has created swift surges in the short term and traders should be ready for volatile price action. It is advised that entry orders are used to make sure price fills meet expectations.

As the USD/INR swirls around important short-term lows, the forex pair has also entered a critical mid-term lower range. Traders will be keen to see if the USD/INR can maintain its value below the 74.9000 level, as of now the 74.8500 ratio is seeing plenty of action. The next technical level via support that should be monitored is the 74.8000 mark. If this area proves vulnerable, traders will look at values traversed at the end of the third week in October, when the USD/INR touched 74.7000 several times.

The USD/INR has produced strong fluctuations and the last time the 74.7000 ratio was tested a rather demonstrative move upwards was produced, a high of 75.1800 approximately was tested on the 25th and 26th – yes, only two days ago. The ability of the USD/INR to climb to these short-term highs underscores the current amount of choppiness within the Forex pair which is acting a bit like a whipsaw.

Traders are encouraged to use take profit and stop loss orders to manage their positions and fight off reversals which are occurring. However, even as choppy conditions are pointed out, it also has to be said that the USD/INR has proven to be within a rather sizeable bearish trend since the 12th of October.

While the Forex pair has certainly bounced off lows being produced consistently, the USD/INR has also been able to incrementally lower support levels the past couple of weeks. Traders may be tempted to use slightly wider stop losses in the short term because of this trading characteristic. This will allow a trade to work longer if the price target remains a goal if market conditions dictate a trade be kept on for a longer duration to get the result wanted.

Cautious traders may be hesitant to be sellers of the USD/INR at these short-term depths, but the bearish trend has been rather resilient. Speculators may want to wait for slight moves towards current resistance levels to ignite short positions and target nearby support levels with take profit orders.

Indian Rupee Short-Term Outlook

Current Resistance: 74.9400

Current Support: 74.8000

High Target: 74.9870

Low Target: 74.6800