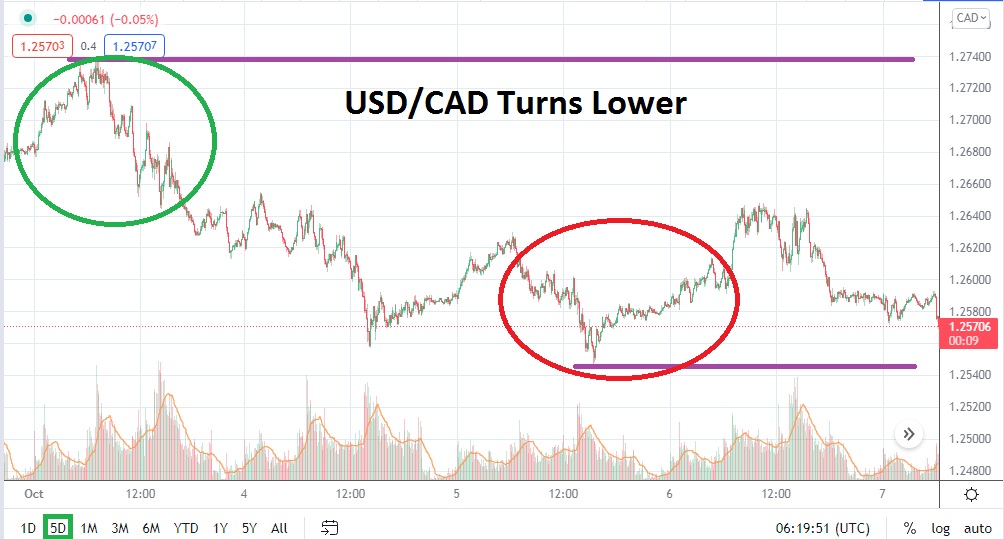

The USD/CAD has been producing plenty of volatility for speculators pursuing the Forex pair. While choppy conditions are certainly part of the USD/CAD trading environment, this is also a perception based on the amount of leverage a trader is using while trying to take advantage of price action. Yesterday, early reversals higher to a fairly consistent resistance level of nearly 1.26500 began to falter and selling pressure again mounted within the USD/CAD.

On the 20th of September, the USD/CAD was trading at nearly 1.29000 after pronouncements from the US Federal Reserve rattled Forex. While the USD has kept up its stronger pace against many major global currencies, the Canadian dollar has actually gone in a divergent direction. A significant factor in the sudden reemergence of strength in the Canadian dollar is due to the impact from the rising prices in the energy sector.

Yesterday’s reversal higher was met by stiff and rather predictable amount of resistance, and the sudden move lower happened in a swift manner. After breaking below the 1.26000 level, the USD/CAD then began to test the 1.25850 juncture and eventually this support level was proven vulnerable too. As of this writing, the USD/CAD is trading near the 1.25700 level in fast conditions. Volatility is likely to remain substantial within the short term.

The USD/CAD is now within sight of September low water marks. On the 2nd of September, the Forex pair tested a depth of 1.24910 briefly. Speculators may feel that this level represents a great distance from the current price of the USD/CAD and they may be right, but it is pointed out to show the pair is not unaccustomed to lower bearish depths. While the USD/CAD may not be trading in correlation with many other major Forex pairs, the current trend remains bearish. Until resistance levels begin to incrementally increase on a steady basis and prove durable, selling the USD/CAD remains rather attractive with a speculative perception.

Cautious traders may want to wait for another round of higher reversals to occur before trying to sell the USD/CAD. Current resistance levels may prove to be rather adequate near the 1.25800 to 1.25900 ratios. Speculators who want to be sellers and remain conservative could wait for slightly higher moves before igniting their selling positions, and looking for support levels to then be challenged again for quick hitting wagers while pursuing additional downward momentum.

Canadian Dollar Short-Term Outlook

Current Resistance: 1.25910

Current Support: 1.25410

High Target: 1.26250

Low Target: 1.25120