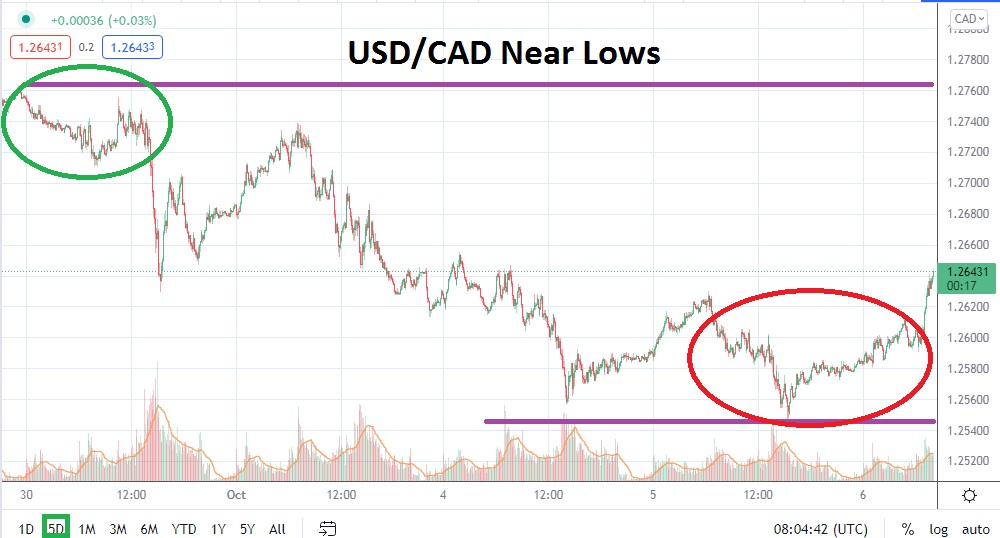

As of this writing, the USD/CAD is traversing near the 1.26300 level and, in the past half day, has produced a rather intriguing upwards reversal. However, this move higher developed after important support levels were tested yesterday between the 1.25400 and 1.26000. Yesterday’s low penetrated the previous depths made only the day before, and these lows tested values not traversed since the first week of September.

Speculators who are comparing the price action of the Canadian dollar to the broad Forex market and note the USD/CAD doesn’t seem to be correlating are technically correct. Traders, however, should take into consideration the rather dramatic increase in oil prices and acknowledge the impact the commodity is likely having on the USD/CAD. Canada is a large producer of oil and stronger energy prices fundamentally create strength for the Canadian dollar.

Resistance near the 1.26500 level should be watched carefully short term. If the USD/CAD is not able to penetrate this slightly higher level and maintains its current value range, this could be an indication that additional downside price action may be generated. Cautious traders may want to see a substantial amount of consolidation below the 1.265000 to feel comfortable about the bearish trajectory and the perception that further selling will occur.

Support ratios of 1.26300 to 1.26250 should be watched carefully too. If these ratios begin to look vulnerable, speculators may be inclined to pursue short positions with the belief that yesterday’s lows may be challenged again and that targets can be legitimately perceived below the 1.26000 mark. However, traders are reminded not to be overly ambitious and if they are able to produce winning positions, it is wise to protect profits by cashing them out, or at a minimum to use a trailing stop loss to insure gains do not vanish.

The trajectory of the USD/CAD has produced significant bearish momentum and yesterday’s reversal higher may prove to be a short-term reaction. Speculators who want to wager on further downside price action may want to wait for slight reversals higher, but they should also acknowledge the USD/CAD has been rather volatile short term and sudden moves could be missed if they act to conservatively.

Canadian Dollar Short-Term Outlook

Current Resistance: 1.26520

Current Support: 1.26280

High Target: 1.26700

Low Target: 1.26020