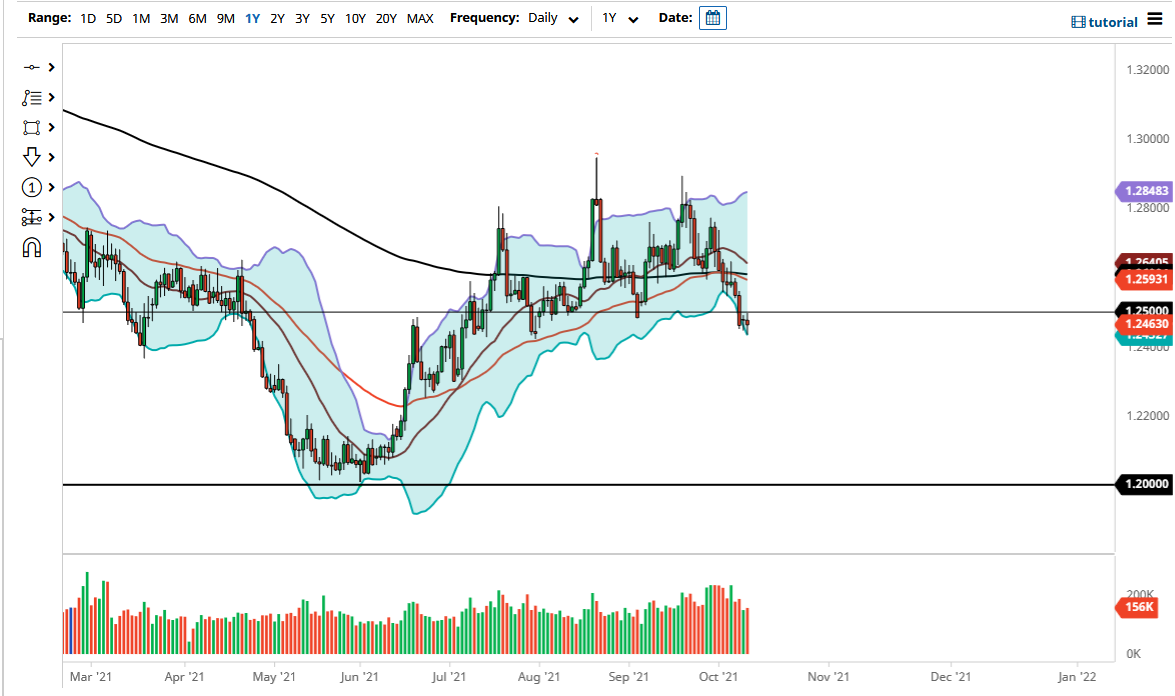

The Canadian dollar fluctuated on Tuesday, sitting just below the 1.25 handle. The 1.25 handle is a large, round, psychologically significant level that a lot of people will pay attention to, so it is a bit interesting to see that we are sitting just below it. That being said, the market also has gotten a bit overdone, and when you apply the Bollinger Band indicator on the chart, you can see that we are hugging the bottom of an expanded indicator.

In other words, this is a market that could get a little bit of a bounce going, and if we can break above the 1.25 handle, it is possible that we would go looking towards the 50-day EMA. It is worth noting that we had recently tried to form a bit of a “golden cross” but rolled over just in time to make sure it did not happen. That being said, a lot of times when we get the setups, we will see several failed attempts before we finally get a significant move.

The Canadian dollar is obviously getting a bit of a boost due to the crude oil market, and the jobs number in Canada being stronger than the jobs number in the United States. That suggests to me that this pair could continue to go lower, but we may be a little bit overdone. If we can break down below the lows of the session on Friday, then I think we could get a little bit more in the way of momentum. At that point in time, I would anticipate that the market would go looking towards the 1.24 handle, and then eventually the 1.23 level.

If we break out to the upside, then it is likely that the market will go looking towards the 50-day EMA, which is sitting just below the 1.26 level. Breaking that could then send the market even higher, but we need to see some type of significant push to the upside to get involved. Furthermore, if the market were to see US dollar strength across the board, then I might be a bit more convinced. As things stand right now, it looks like we are likely to drift a bit lower, but we need to see some type of impulsive candlestick in order to put money to work.