The USD/BRL is now traversing values it last tested in April of this year. As of this writing, the USD/BRL is near the 5.5300 juncture, and when it opens for trading today, traders will be keen to see if the 5.5000 level can be sustained. From late February until the third week of April, the USD/BRL largely traded above the 5.5000 juncture and it reached a high of nearly 5.8700 late in the first week of March.

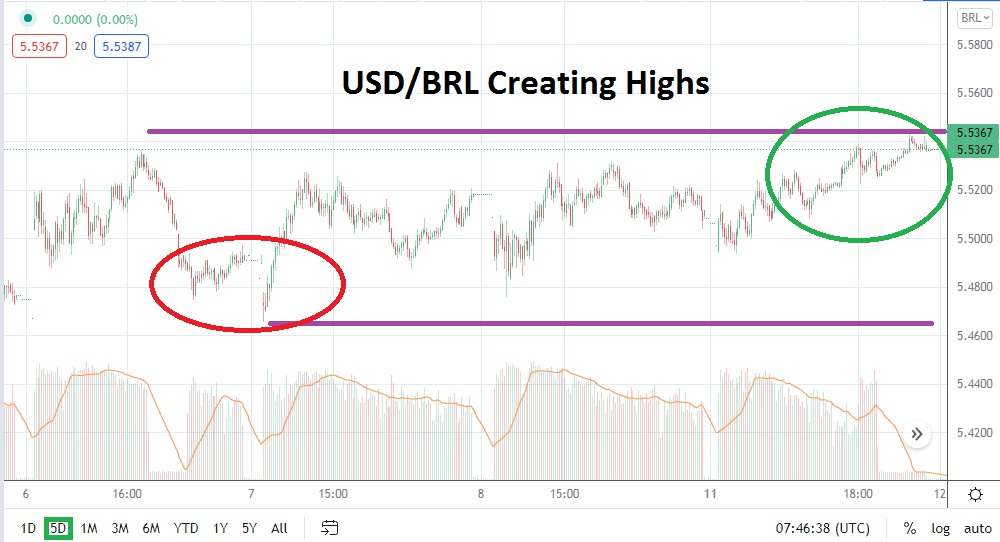

On the 31st of August, the USD/BRL was trading near the 5.1200 level and, on the 25th of June, the Forex pair actually touched the 4.8000 vicinity. However, a bullish trend has once again been firmly established within the USD/BRL and it has been demonstrated in earnest since the beginning of this September. Technically, the USD/BRL has seen a flurry of price velocity since the 1st of October. On the 8th of October the USD/BRL was trading near the 5.4800 level, but before going into the weekend it touched a high of 5.5300.

Intriguingly, yesterday’s trading was able to sustain Friday’s gains and showed that the 5.5000 level could be held. Short-term speculators may want to look at long-term charts to gauge the potential direction for the USD/BRL as it challenges these highs last sincerely traded in April. If the 5.5300 level is able to be maintained today, traders may believe this is a clear bullish signal and decide to target the 5.5600 level. If this higher mark proves vulnerable and is penetrated, the next logical goal for short-term speculators may be the 5.5800 to 5.6000 range.

The USD/BRL is capable of delivering sudden volatility. The use of proper risk management is essential to guard against potential swift reversals. However, the trend of the USD/BRL has been bullish and there is reason to suspect higher price levels may be legitimate targets for speculative wagers. Conservative traders should wait to see how the USD/BRL opens today, and if the price of the pair moves slightly lower, but maintains value above the 5.5000 mark, it may prove to be attractive to pursue moves higher.

Brazilian Real Short-Term Outlook

Current Resistance: 5.5600

Current Support: 5.4950

High Target: 5.6130

Low Target: 5.4480