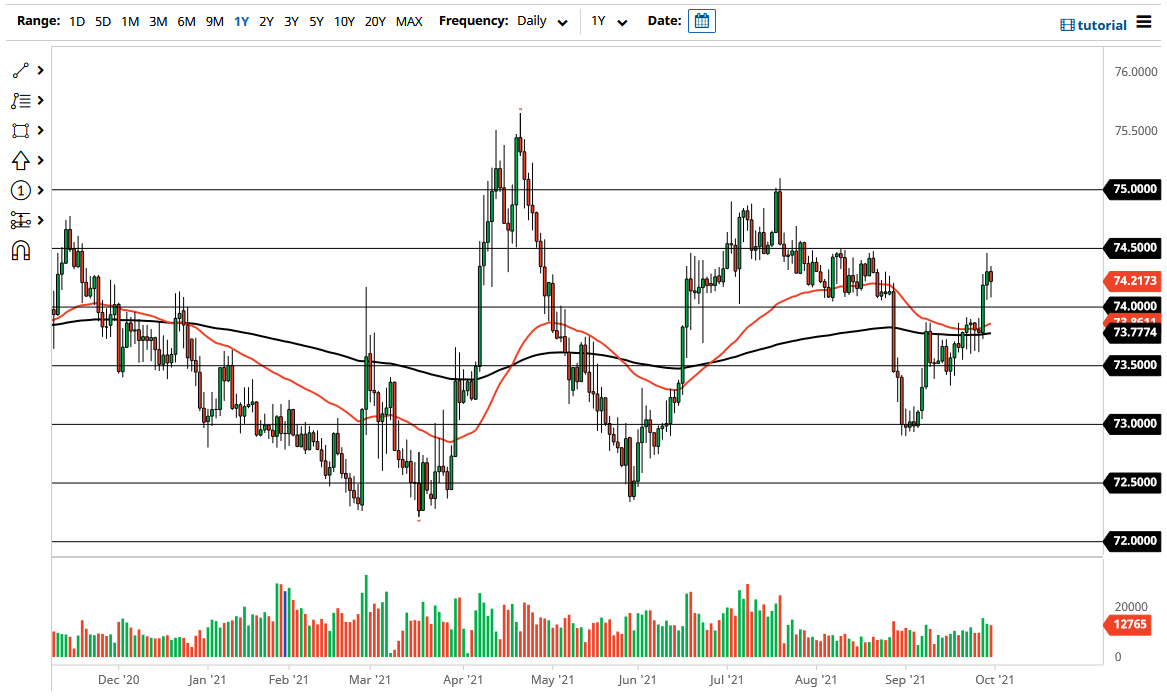

The US dollar initially pulled back just a bit during the course of the trading session on Thursday but then turned around to show signs of life again against the Indian rupee. The area right around ₹74 continues to offer support, as the 50 day EMA is starting to reach towards that area, and it is of course scenario where we had sold off quite drastically several weeks ago. In other words, there is a certain amount of “market memory” that comes into play in this area.

Speaking of “market memory”, you can also make an argument that the ₹74.50 level had previously been resistive, so the fact that we could not break above there is not a major surprise. Furthermore, if we can break above that level, it would be an obvious sign that we are going to go higher, perhaps reaching towards the ₹75 level, which was a major level of the selling pressure. If we can break above the ₹75 level, then it is likely that the market will take off for a bigger “buy-and-hold” type of situation. The market breaking out above that level obviously is a very strong sign, and therefore I think that it would become more of a “buy-and-hold” type of situation. This of course could be a nice longer-term play, but we are nowhere near that breakout quite yet.

Keep in mind that the RBI is very sensitive to where the rupee goes, and therefore the tend to manipulate the pair overall. That being said, a weakening rupee is probably something that Indian bankers will probably welcome, as India was particularly hard-hit by the coronavirus outbreak. That being said, if we were to turn around a break down below the 200 day EMA, then it is likely that the market goes looking towards the ₹73.50 level. If we can break down below that level, then it is possible that we could go down to the ₹73 level area underneath, which is where we had bounced significantly from. All things been equal though, this looks like a market that is going to continue to try to go higher over the longer term, especially as the US dollar has seen strength against even more mainstream currencies at the same time. This is a simple knock on effect where we have greenback strength bleeding into this pair.