The S&P 500 initially fell on Wednesday but then turned around to show signs of life again. This is a market that continues to find plenty of reasons to throw itself back and forth, so it is not a huge surprise to see that this has happened. This being the case, we are heading into the earnings season, so it does make sense that we would see the market try to figure out where to go next.

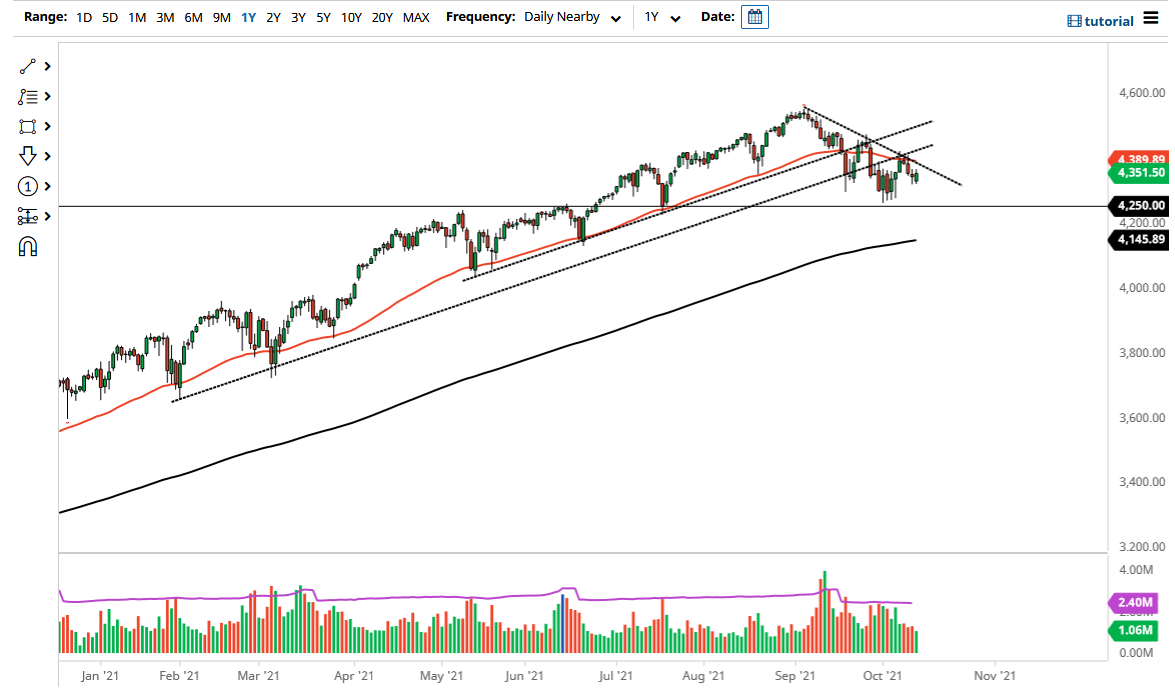

The 50-day EMA is sitting above and at the downtrend line, so I think we will continue to see a lot of pressure just above. That being said, we also have a significant amount of support underneath at the 4250 level. We have seen the market test that area multiple times, so it looks as if we are going to continue to see buyers in that general vicinity. At this point, if we were to break down below that level, the market could go looking towards the 200-day EMA at the 4145 handle, but I would not be a seller of this market. I might buy puts, in order to protect my account more than anything else, because the Federal Reserve has been manipulating this market for at least a decade.

On the other hand, if we can break above the 50-day EMA, then it is likely that the market will go looking towards the 4450 level, followed by the 4550 level. After that, then we would continue to be more or less a “buy and hold” type of market, as we typically are. With earnings season starting, expect volatility as it is likely that we will see plenty of it. In general, this is a market that only goes higher over the longer term, and despite the fact that it has been very difficult as of late, when you look at the longer-term chart you can see that we are still clearly in a bullish trend, and I just do not see that changing anytime soon. To the upside, I would anticipate little bits and pieces of trouble, but ultimately the massive amounts of liquidity in the system will continue to push this market higher, despite the fact that the Federal Reserve is talking about tapering.