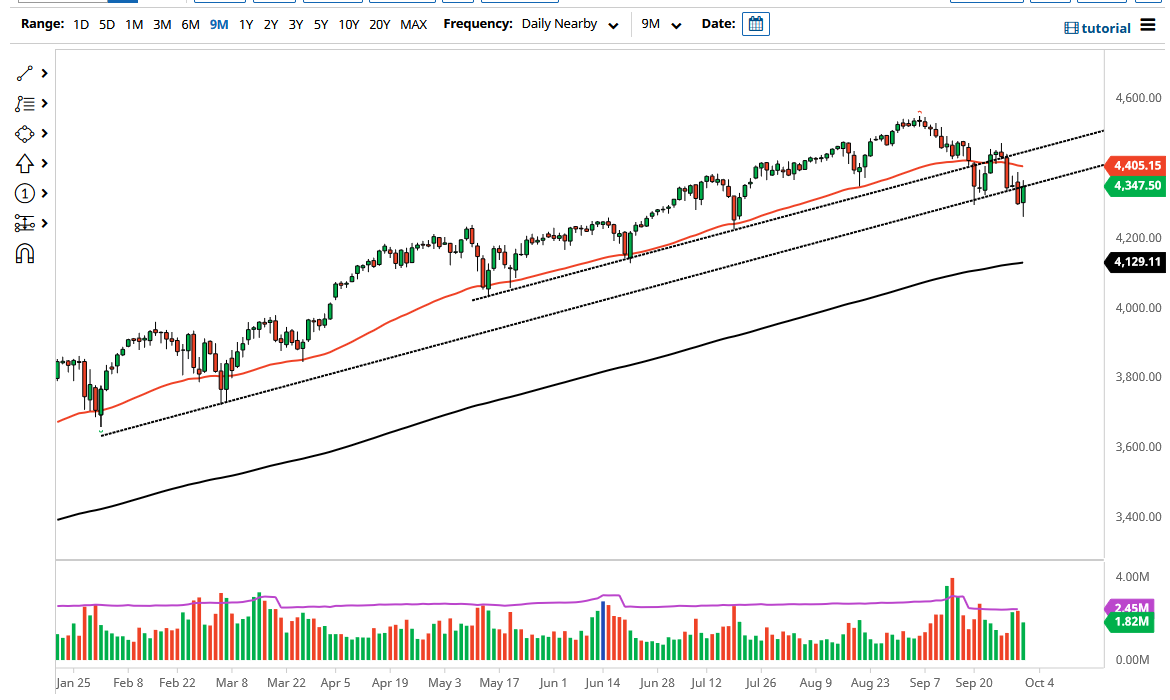

The S&P 500 initially fell on Friday but then turned around to show signs of life again. By doing so, we ended up taking back the entire body of the Thursday candlestick, but we also have the previous uptrend line that is sitting there offering a certain amount of resistance. With that in mind, I think it is difficult to imagine a scenario in which we simply take off to the upside, not only because of that uptrend line but also the fact that the 50-day EMA is starting to curl lower.

If we were to turn around and break down below the lows of the trading session on Friday, then it is likely that the S&P 500 will go looking towards the 4200 level. This is a market that I think continues to see a lot of choppy behavior more than anything else, and I do think that we have further negativity ahead. You should keep in mind that Friday was the end of the third quarter, so it is very likely that we will see a lot of position squaring.

Looking at this chart, I think that we probably are trying to find some type of floor in order to continue going higher. After all, the market continues to find plenty of buyers regardless of what happens, and at this point it is almost impossible to fight a market that is manipulated by the Federal Reserve itself. If we do sell off quite drastically, it is only a matter of time before the Fed steps in and involves itself in the bond markets, or at least send markets back to the upside via jawboning.

To the upside, if we can get above the 50-day EMA, then it is likely that we will go looking towards the shooting star from earlier in the week, and if we can break above there, then it is likely that the S&P 500 will continue the overall uptrend. You do not short US indices, because the market is continuously finding reasons to get long, and with liquidity measures and inflation coming, there is no real yield to be had anywhere so money is being forced into the stock market over the longer term.