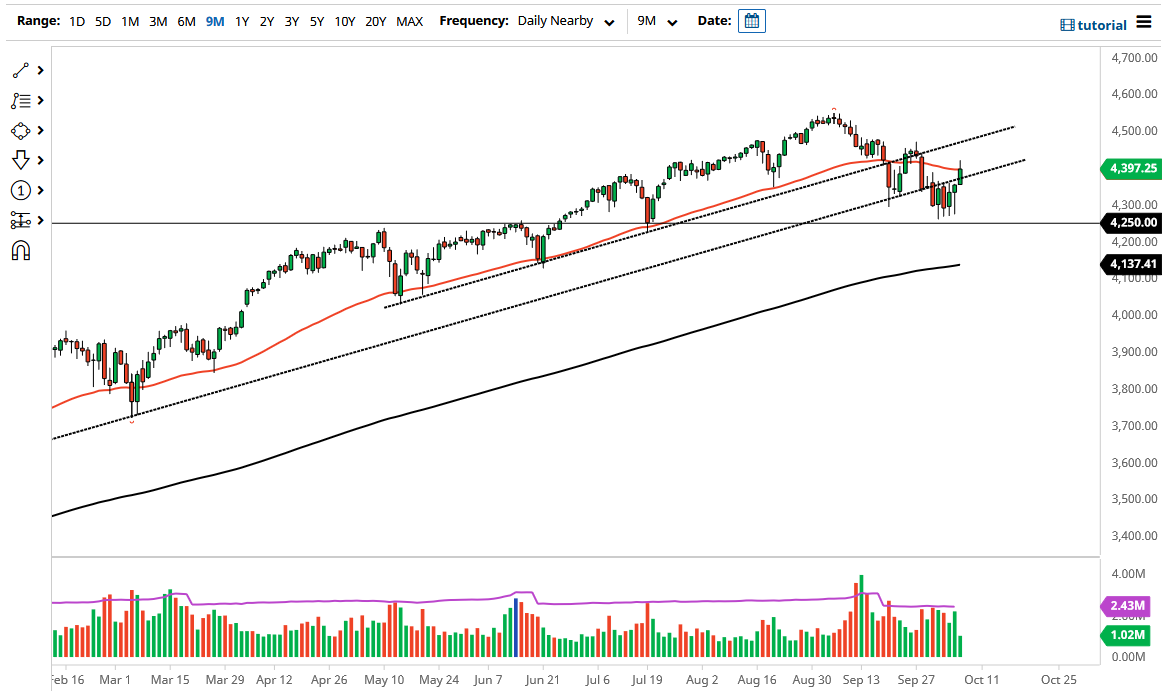

The S&P 500 has rallied significantly during the course of the trading session on Thursday to break above the 50 day EMA. However, we have struggled just a bit near the 4400 level which is also right there at the 50 day EMA, so with that being the case it is likely that we continue to see a little bit of trouble. Pullbacks at this point in time will more than likely offer a significant amount of support, with the 4250 level underneath offering quite a bit of support.

Breaking down below the 4250 level could be a very negative turn of events and possibly even open up a move down to the 200 day EMA which is closer to the 4137 level. That is an area that I think will eventually hold, unless of course we have some type of massive meltdown, but that does not seem very likely this point. In fact, indices around the world recovered quite nicely during the trading session on Thursday, and it suggests that we are about to see a rush back into equities worldwide.

Part of what has been causing issues has been the issues with Evergrande, which seems to be heading back to the rearview mirror. The market has been very noisy as of late, and I think it does continue to be that way going towards the end of the year. After all, there are a lot of questions as to whether or not we are going to re-accelerate when it comes to growth or have we seen the peak?

The nice little pullback that we have had as of late is of the garden-variety, and like we have seen multiple times over the last 13 years. As long as the Federal Reserve is going to liquefy the markets, it is very unlikely that they are going to fall for any significant amount of time. Quite frankly, Jerome Powell and his friends at the Federal Reserve will make sure that the traders on Wall Street continue to make money, because that is what they do. It has been that way for at least 13 years, so at this point in time there is no point in fighting it. As soon as you divorce the idea of the economy in the stock market being related, you understand that it is about liquidity flows which continue to be massive.