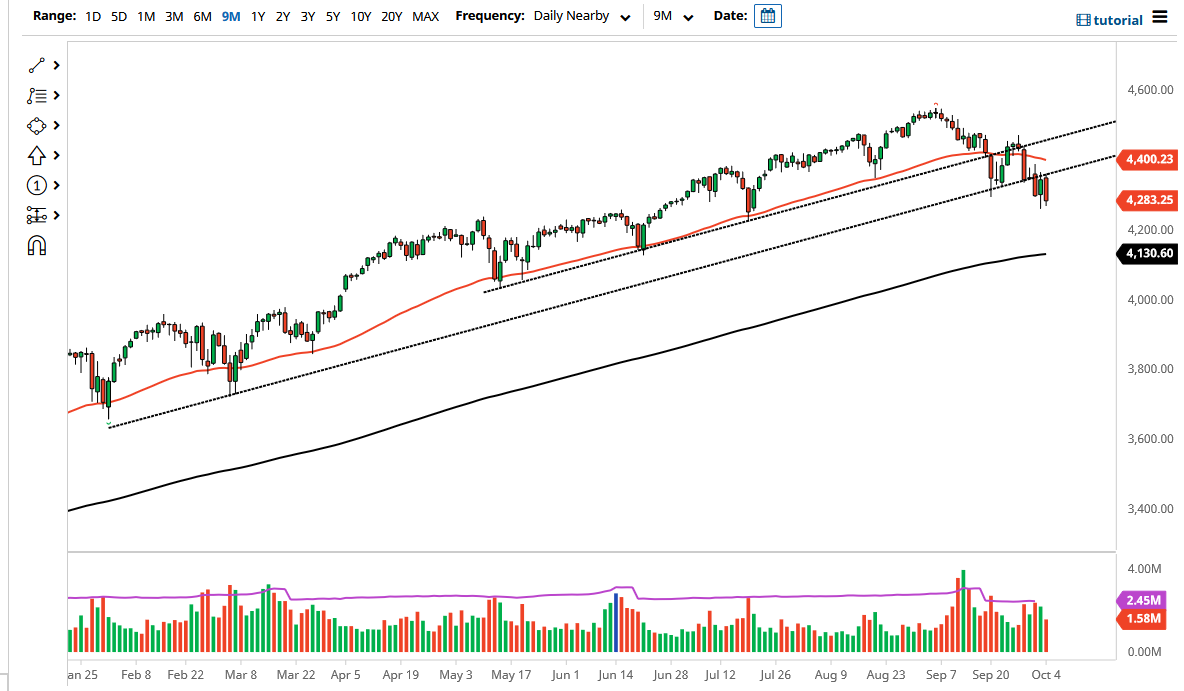

The S&P 500 pulled back yet again on Monday to show signs of selling pressure. If we can break down below the lows of the Friday session it is very likely that we will go looking towards the 4200 level. The 4200 level is an area that is starting to attract a certain amount of attention due to the fact that the 200-day EMA is reaching towards that area. That being said, the market is likely to continue to see value hunters in the market given enough time.

If we break down below the lows of the trading session on Monday, then I might be a buyer of puts. The market continues to see a lot of problems with the Federal Reserve pumping up liquidity measures, so as they start to talk about tapering it makes sense that we would cause this market to drop. That being said, I would not be short of this market, simply due to the fact that you can only buy puts because you're at least protected.

Signs of support on a daily close underneath could be a nice buying opportunity, and I think you will see a nice longer-term trade given enough time. That being said, if the market was to break down below the 200-day EMA, then it is likely that we could go much lower. Underneath there, then we have to worry about the 4000 handle which is a large, round, psychologically significant figure that would attract a lot of headline attention. The market breaking down below there really kicks things into a negative move. The market continues to be noisy, but regardless of what happens next, I believe it is only a matter of time before you can get long and start to build a bigger position going higher. This type of pullback is exactly what I have been hoping to see, because it could give you an opportunity to continue to add to what has been a longer-term uptrend.

In the short term, though, we have a significant amount of trouble and volatility coming, so you need to be cautious about your position size if you do try to dip your toe in the water and go long.