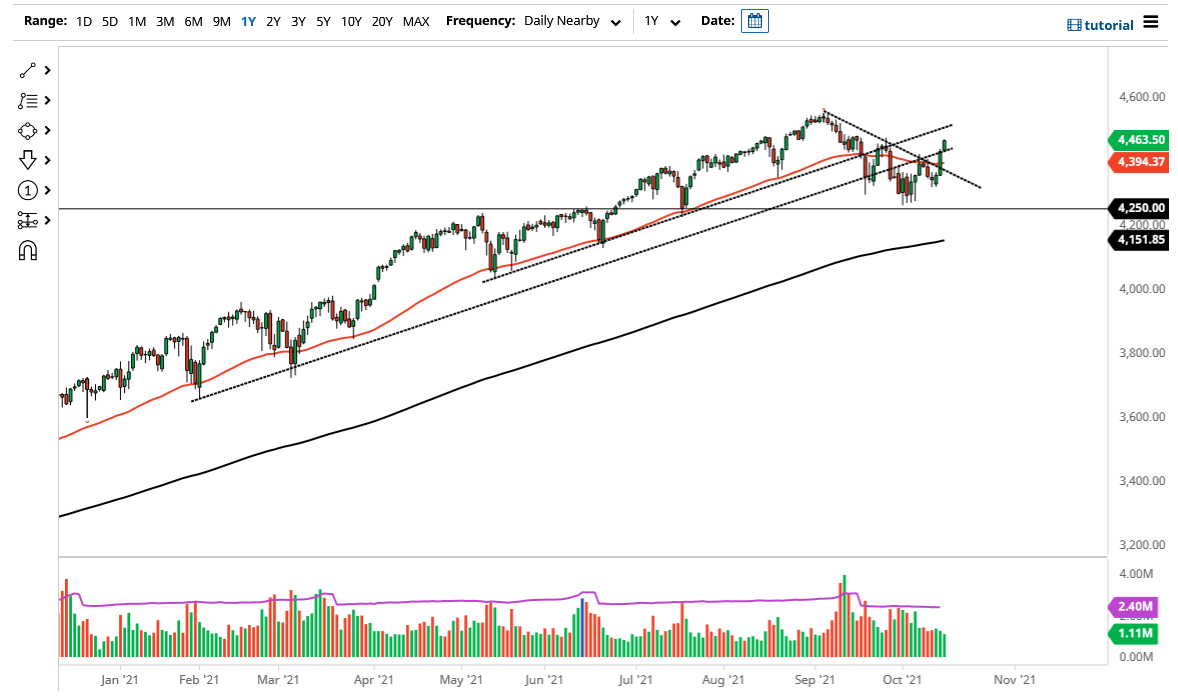

The S&P 500 broke to the upside on Friday to clear the highs of the Thursday session. At this point, the market looks as if it is trying to break higher as the inverted head and shoulders has kicked off. The S&P 500 is likely to see a move towards the 4600 level.

When you look at this chart, the 50-day EMA underneath is a massive support level, now that we are well above it. The market looks as if it is a “buy on the dips” situation and the earnings season kicking off with such strength helps quite a bit as well, as the banks have all shown massive profits. Now that we are in earnings season, there will be a lot of catalysts potentially coming into the market to allow the S&P 500 to continue rallying. Even if we do pull back from here, there will be plenty of buyers to get involved, and it is not until we break down below the 4250 level that I would be concerned about the overall uptrend. At that point, might be a buyer of puts, but I certainly would not short this market anytime soon.

The 200-day EMA underneath continues to be an indicator that a lot of people will pay attention to, but at the end of the day I think it is likely that we will see a bit of a reaction to that area. If we break down below that level, then we could really unwind to go looking towards the 4000 handle. The 4000 level is a large, round, psychologically significant figure, and will attract even more headline attention. That being said, that is not my best case scenario, but I do also recognize that the possibility exists. Buyers will continue to pick up any bits and pieces of value that they can, so if we see some type of big earnings miss, it is likely that people will jump back in and take advantage of it. On the other hand, we could break above the 4500 level rather quickly, which also gives us yet another reason to think that we are going to go higher.