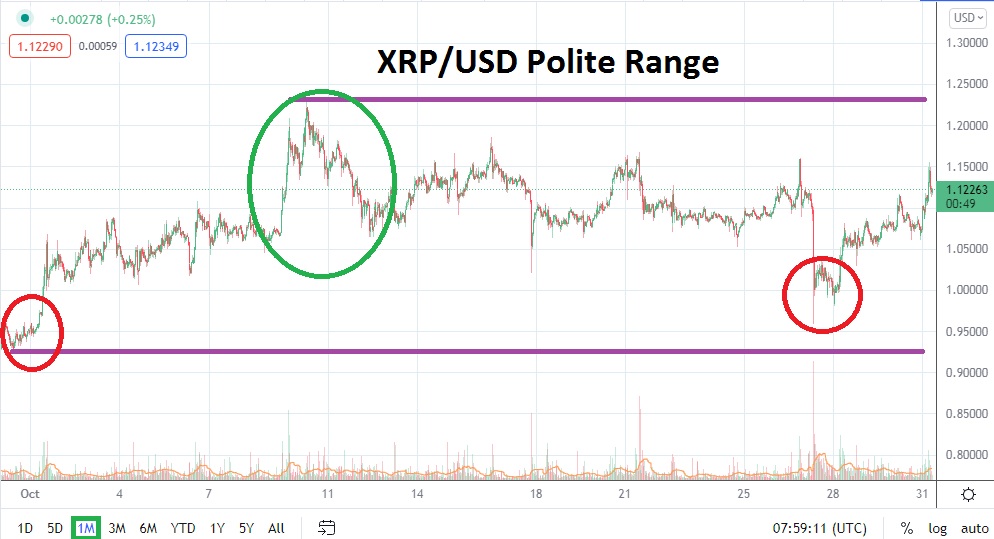

As the month of November gets ready to start, XRP/USD finds itself within a polite trading range. While Ripple has not produced earth-shattering results regarding speculative volatility, it has demonstrated an ability to trade within a known price band and provide cautious traders a degree of comfort which they might not feel with many of the other major digital assets. Ripple remains the 7th ranked cryptocurrency regarding market capitalization with over 52 billion USD in value.

The month of October essentially saw XRP/USD begin trading near the 0.95000 cents level and a high of approximately 1.23000 was attained on the 10th of October. This result may actually make speculators who crave upside volatility nervous. Ripple has not joined the over exuberant party many of its major counterparts have enjoyed the past few weeks. October’s high remained far below the high of September which reached about 1.41000 in the first week of the month.

Perhaps this is good news for XRP/USD as it coalesces within its ‘business environment’ and is used as digital asset allowing for global banking transactions. However, speculators looking for upside potential may not be drawn to Ripple like other cryptocurrencies because of its lack of a large voice from influencers.

Yet, this may also attract more conservative traders who want to pursue ‘softer’ trends as they speculate. The ability of XRP/USD to go from 95 cents to nearly 1.23000 in less than two weeks is almost a 25% change in value. Which compared to most financial assets is quite staggering and large, so do not let its ‘comfortable’ range fool you.

Incrementally XRP/USD is has come down from its early October highs, and this may be causing angst among some bullish speculators. As the month of November gets started, it appears Ripple will begin trading near the 1.12000 ratio, this after seeing a substantial amount of volatility only a couple of days ago when its dropped below the one dollar value on the 28th and 29th of October.

Ripple Outlook for November

Speculative price range for XRP/USD is 0.85000 to 1.42000.

Ripple has not been able to create a violent trend upwards and maintain it the past two months. While other major cryptocurrencies are challenging highs, XRP/USD has maintained a rather middling area within its 3-month charts. If current support near the 1.05000 level falters and trading were to drop below the 1.00000 and become sustained this would be a bearish signal. Ripple does tend to correlate to the major cryptocurrency market with reactive moves. If the broad market were to become suddenly nervous and XRP/USD is pressured, it is conceivable a test of the 90 cents mark which was challenged in late September could unfold again.

However, if XRP/USD maintains the 1.10000 support level and buying remains strong, speculators may continue to target the 1.18000 to 1.20000 marks. If Ripple can maintain its current upwards mobility and the broad cryptocurrency market stays positive, there is plenty of reason to suspect the 1.22000 high of October could be surpassed in November. Sustaining values above the 1.20000 for a solid duration of time could be a bullish indicator for XRP/USD. Traders should not get overly ambitious with Ripple. Yes, it can produce solid percentage changes in value, but its price range has also demonstrated a rather comfortable stance.

Traders pursuing upside or downside momentum within XRP/USD should use take profit and stop loss orders which do not reach for the moon, particularly if a large amount of leverage is being used. Ripple remains an important cryptocurrency, but one that trades in a rather sedate manner compared to some of its other more speculative counterparts.