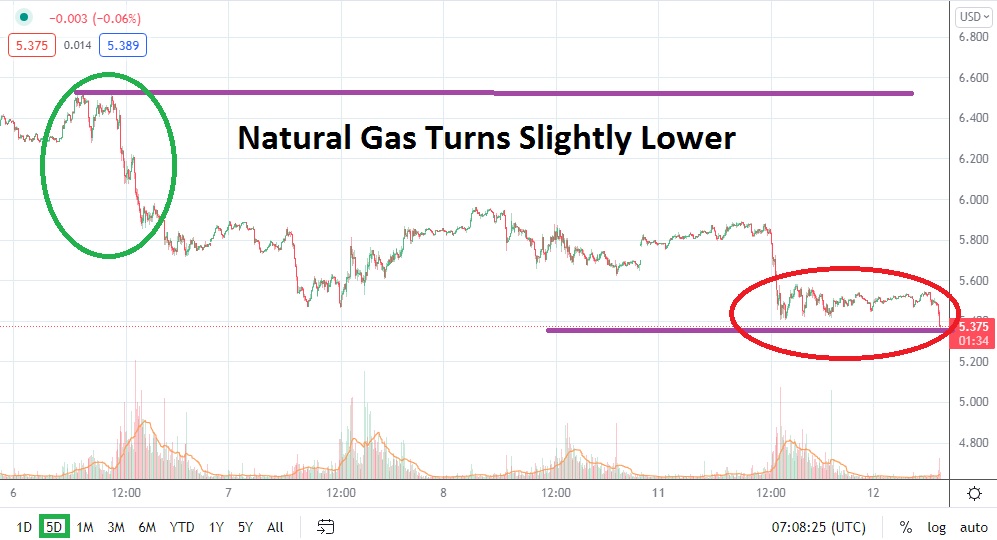

Natural gas, as of this writing, is near the 5.350 level after experiencing a volatile day of trading yesterday and falling from a high of nearly 5.880. Natural gas remains within the upper realms of its long-term price range, and it should be remembered that on the 6th of October a high of approximately 6.520 was touched. To put the current price ratios of natural gas into perspective, the last time the value of the commodity touched these highs was in February of 2014.

Another historical note of significance is that natural gas is flirting slightly below values it has not actually seen sustained trading since the calendar years between 2003 and 2008, when natural gas production was much lower than it is now. Technically, natural gas came off highs this early October as a flurry of nervous sentiment cascaded through the energy sector led by media coverage that European nations could suffer from shortages of the commodity this winter.

Yesterday’s prices in WTI Crude Oil did hit high water levels not seen for a long time, but importantly, natural gas didn’t actually react or correlate to its counterpart. Natural gas prices do not dance in a ‘lock step’ with the price of crude oil. However, the upper realm natural gas is traversing has shown a sincerely strong bullish trend like other energy commodities since late last year.

Support near the 5.300 juncture should be monitored by traders and, if this level proves vulnerable, a test lower to the 5.200 mark could develop. However, speculative bulls may look at any strong movement downward as a potential buying opportunity with their sights set on reversals higher. If natural gas begins to incrementally step higher and the 5.450 level begins to be challenged, it could signal additional buying momentum could ensue.

Yesterday’s sell off in natural gas may attract speculators who believe the long-term trend of the commodity still have power to generate. Traders are advised to use risk management wisely, because natural gas can produce volatile trading with swift changes in direction. Buying natural gas on slight reversals lower by traders and looking for upside action remains the logical speculative wager near term.

Natural Gas Short-Term Outlook

Current Resistance: 5.460

Current Support: 5.290

High Target: 5.750

Low Target: 5.190