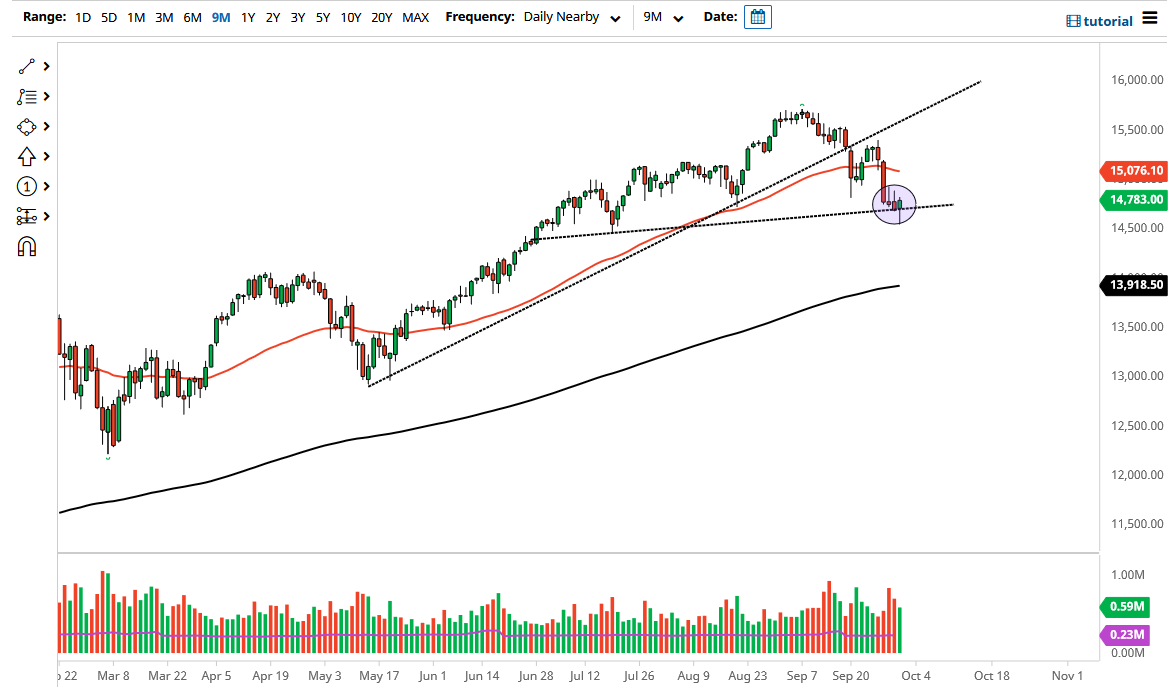

The NASDAQ 100 initially broke down on Friday before turning around to form a bit of a hammer. What I find interesting about this is that we are sitting on top of an uptrend line, and that is a very bullish sign. That suggests that the market is trying to find its footing, and it will be interesting to see how this plays out over the next couple of days. What I find particularly interesting is that we have formed a couple of inverted hammer candlesticks during the previous two days, which suggests that there is downward pressure overall.

I do believe that the highs of the inverted hammers and the lows of the hammer suggests that we are going to have a short-term choppy market. If we break down below the bottom the hammer, then it is very likely that the NASDAQ 100 will continue to drop significantly, perhaps down to the 200-day EMA which is going to be racing towards the 14,000 level. On the other hand, if we do break above the top of the candlesticks from both Wednesday and Thursday, then we will clear 14,900 and go looking towards 15,000 or even the 50-day EMA.

This is a market that is highly sensitive to risk appetite and bond markets in general. The higher yields go, the more likely we are to see a bit of negativity in this market. On the other hand, if yields start to drop, then traders start looking at “growth stocks”, which make up a bulk of what pushes the NASDAQ 100 over the longer term. After all, there are just a handful of companies that move most of this index. The market has been very volatile as of late, and I think that is going to continue regardless. Because of this, you need to be very cautious with your position size, because this is a scenario that is going to lead to an explosive move given enough time. Only add once the market proves your position correct. This is not the time to be a hero, as when you get to these inflection points it is almost always very messy to say the least.