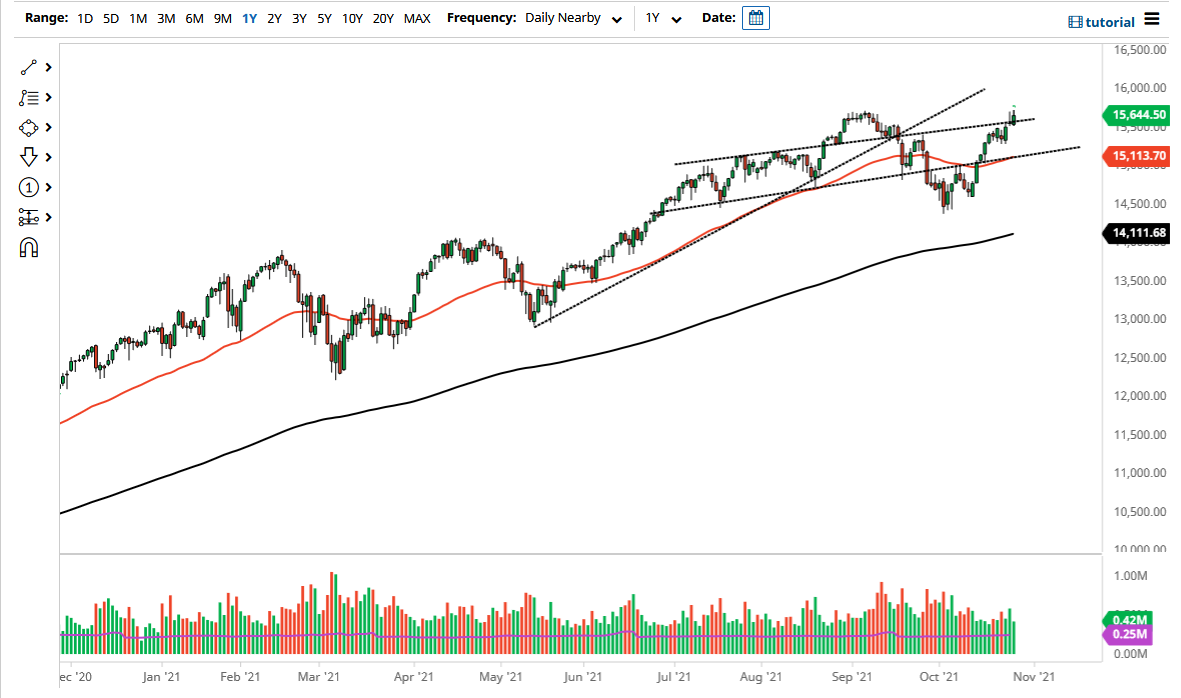

The NASDAQ 100 rallied a bit on Wednesday to make another all-time high. That being said, there was a massive selling program that enters the market at 3 PM Eastern Standard Time, suggesting that perhaps there was a lot of profit-taking going on. If the market can hang on to this overall region, then it is likely that we will see the NASDAQ 100 continue to go much higher. Long term, I do think that is what will happen, but as traders around the world fear earnings season, a certain amount of profit-taking probably has been necessary. I do not necessarily think that the selling late in the day had anything to do with anything more than precautionary movement.

The 50-day EMA sits underneath and is offering a significant amount of support, sitting right above the 15,100 level. By doing so, it suggests that the market is going to continue to try and push even higher. Ultimately, this is a market that I think will find one reason or another to rally and go looking towards the psychologically important 16,000 level. I do not necessarily know if the 16,000 level carries any more importance than the fact that it is a big, round, psychologically significant number, but it makes a nice target for pundits to talk about.

Keep in mind that just a handful of the same stocks tend to move the NASDAQ 100 in general, so all of the usual suspects such as Tesla, Microsoft, and Amazon should be paid close attention to. The market is in a bullish pattern, so even if we do get a bit of a selloff here, I think it only offers an opportunity in the long run. With that being the case, I like the idea of buying dips, and will continue to do so as this market offers plenty of opportunities over the next several weeks. As far as selling is concerned, I have no interest in doing so, but if we break down below the 14,500 level, then it is possible that I could be a buyer of puts, as it is the safest way to short US indices due to the fact that they are so highly manipulated by the Federal Reserve and jawboning from officials. Liquidity continues to trump everything else, so earnings are only a minor point of contention.