Despite the strength of the US dollar, the price of gold appears resilient with the support of many global factors. First and foremost is the continuing COVID-19 epidemic and related global geopolitical concerns. The price of gold is stable around the $1,763 level as of this writing. Speakers at the London Metal Exchange (LME) Symposium on October 11 said that China will continue to have a positive impact on metals demand and prices despite the current slowdown in economic growth and concerns about its real estate sector that could lead to structural changes.

Delegates at the symposium heard that China's moves to decarbonise, with a goal of 2060 net carbon emissions, along with worldwide decarbonization, would be supportive of more demand for minerals in particular. China's role in the future direction of metals markets cannot be underestimated, said Nicholas Agusin, chief executive of Hong Kong Stock Exchanges and Clearing (HKEX), owner of the London Metal Exchange since 2012.

China's "massive recovery" from the market slump due to COVID-19, buoyed by massive stimulus, means the Asian giant's GDP growth trend is now above the level of the previous virus trend, with exports of some goods 40% higher than pre-COVID-19 levels, according to the report.

US third-quarter GDP is expected to be above pre-virus levels, and there has been a "rapid recovery" in mobility in Germany, the US and the UK in recent weeks, despite some shortages in energy, fuel, goods and labor which may be linked together and last for 6-12 months.

Although the pace of real estate development in China has been "unsustainable," as evidenced by the difficulties now facing major builder Evergrande, and a looming structural slowdown, 3-4% economic growth can be judged sustainable, said Schering. He said that while global and regional economic growth rates may slow in 2022 from 2021, it is unlikely that there will be a slowdown in consumption due to the accumulation of savings during the lockdown and due to stimulus funds.

"It's not like the global financial crisis, the global economy is going to see a full recovery from COVID but we're getting into the hard part," Schering added.

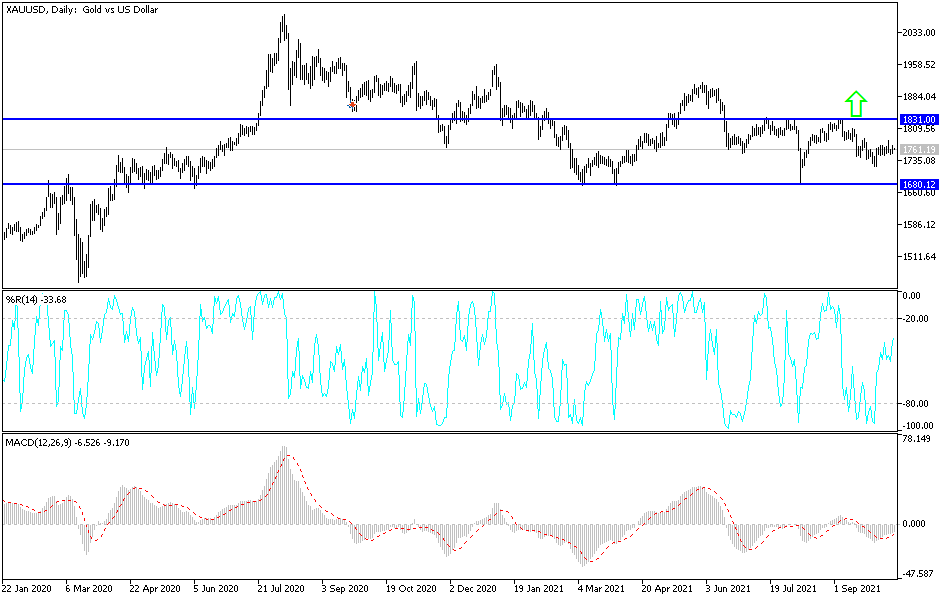

Technical analysis of gold

Gold will react to US inflation figures today, then to the minutes of the FOMC, which will strongly affect the US dollar, and therefore gold. So far, the trend is neutral, and it will start becoming bearish if prices move towards the support levels at $1753, $1740 and $1729. On the other hand, the psychological resistance of $1800 will remain vital for the bulls to continue controlling the trend. I still prefer buying gold from every bearish level.