Gold markets initially fell on Monday to reach down towards the $1750 level. At that point, the market turned right back around to show signs of life again, as we then broke above the $1770 level. Having said that, by the end of the day we did pull back just a bit, but it does show that perhaps gold may have further to go to the upside. Nonetheless, this is a market that has been very choppy to say the least, so that is something worth paying attention to.

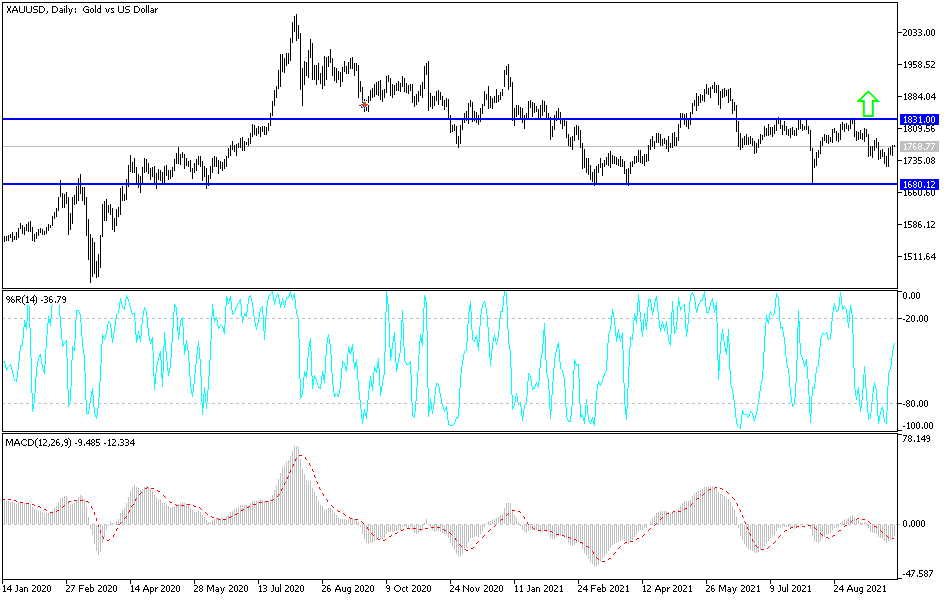

The 50-day EMA currently sits at the $1782 level and is sloping lower. That could cause some issues as well, and I think at that point a certain amount of technical trading will occur, perhaps shorting the market. Breaking above that then opens up the possibility of a move towards the $1790 level, which is at the top of the most recent high. Breaking that would be a very bullish sign because it could open up the possibility of the trend changing in general, perhaps sending the gold market towards the $1830 level. That being said, it is going to take a significant amount of momentum to make that happen, and it is likely that we would have to see some type of major move in the bond market.

Remember, higher interest rates are toxic for gold, as it becomes cheaper to hold paper than it does to store huge amounts of metal. That being said, if bond rates start to drop again, that also helps gold, and that may be part of what was driving the narrative during the day on Monday. It has been extraordinarily choppy as of late, not only in the bond market but everywhere you look. Even though the gold market has been extraordinarily negative, you can see that it has not been a straight run to the downside. It has been very volatile, and I think that will continue to be the way going forward, regardless of the market you trade. The most important thing you can do is place a trade with a small position, and then add as it works out in your favor. Jumping “all in” into this market in either direction is going to be extraordinarily dangerous.