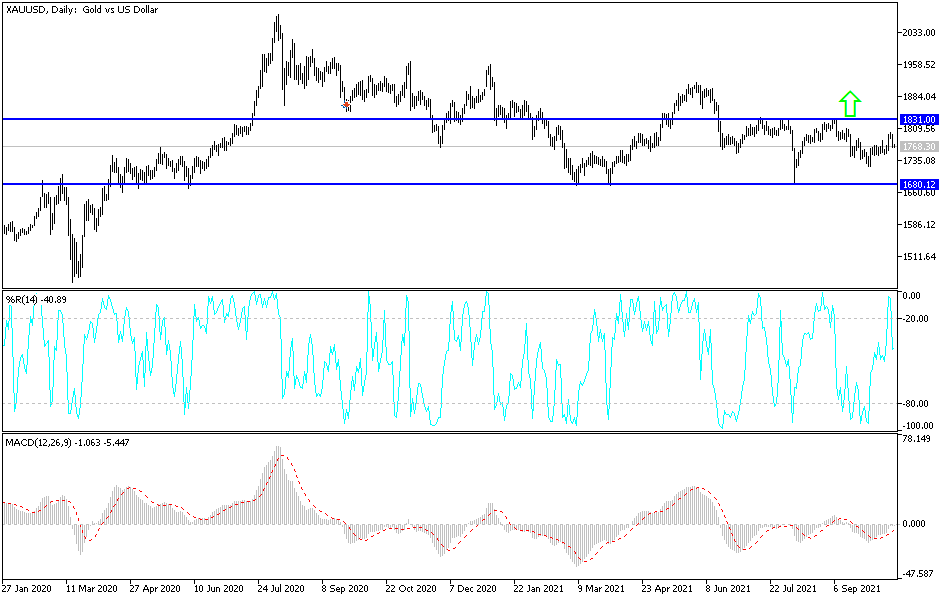

Gold markets got absolutely hammered to end the week on the back foot. The 200-day EMA, the downtrend line, and the $1805 barrier have all combined to send this market much lower. The size of the candlestick is rather interesting, as it shows quite a bit of negativity, but it is still sitting above a short-term support level. After all, the week ended up positive, despite the fact that Friday was a disaster for gold bulls.

The $1750 level underneath is a major support level, and as long as we can stay above there I think we are probably in good shape to at least turn around and try to break out. The downtrend line will be difficult to get above, but if we do close above there on a daily chart, then I would consider going long again. The markets will continue to be very noisy and choppy and will have a certain amount of influence from external factors such as the yields coming out of the United States. Speaking of which, if the 10-year note in America continues to expand higher, that makes gold a lot less attractive as it is an asset that not only has no yield, but it costs money to store. That works against gold, as it typically does poor when bonds are starting offer a bit of yield, especially if it is due to the fact that the economy is growing.

That being said, I think that the market will continue to be very noisy, so you need to be cautious with your position size. There will be sudden shifts just as we have seen on both Wednesday and Friday of this week, as the bond markets are all over the place right now. As long as there is volatility in the bond market, there is going to be significant amount of volatility at times in the gold market, which is a much thinner market than treasuries. If we were to break down below the $1750 level, that could open up a move down to the crucial $1680 level, an area we have bounced from a couple of different times. Anything below that level opens up massive selling, perhaps down towards the $1500 level over the longer term. It is worth noting that we are still in the midst of a descending triangle, so that must be kept in the back of your mind.