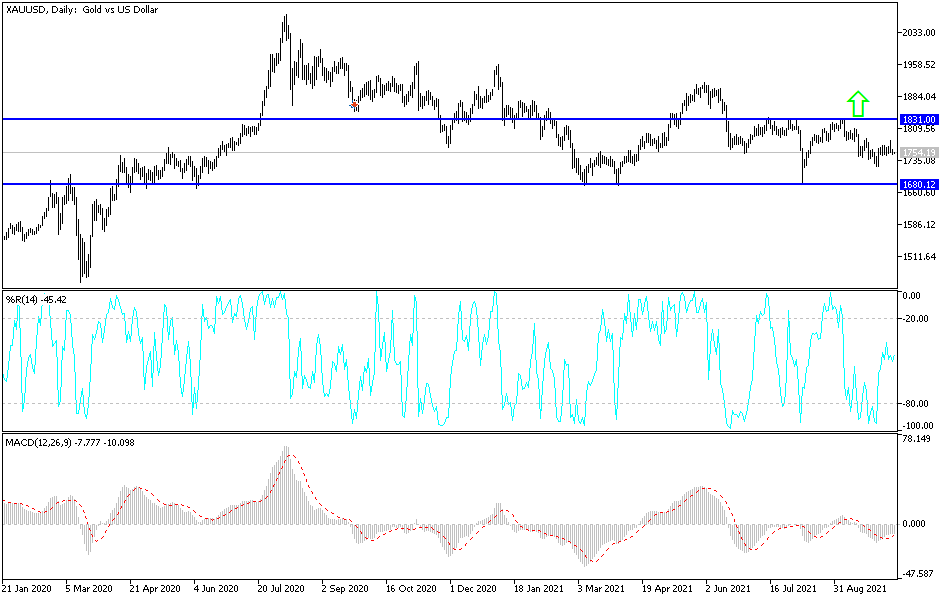

Gold markets were all over the place on Monday as we continue to see a significant amount of volatility and choppiness. After all, this market is highly influenced by what is going on in the bond markets, which worldwide have been calling for higher yields. If you can earn more yield via paper than storing a hard asset like gold, it makes sense to own that paper. Furthermore, you have to pay close attention to the US dollar, which had been rallying during most of the day against its European counterparts. That being said, the dollar skyrocketed against the Japanese yen but fell against the Australian dollar. In other words, it is a very choppy and erratic mess.

That being said, it is worth noting that the Friday session initially was very bullish but gave back the gains to form a massive shooting star. Beyond that, the shooting star stopped right at the 50-day EMA, so that in and of itself is probably something worth paying attention to as well. We did end up breaking down below that shooting star-shaped candlestick during the day on Monday but did not have a ton of follow-through. I think we need to get below the $1750 level in order to really start to pick up momentum. If we do, then this market will probably go looking towards the $1725 level, where we had seen a little bit of support. After that, then I would anticipate a move to the $1680 level, an area that has been important multiple times.

One thing is for sure: we are going to see a lot of choppy volatility until some type of decision is made. Because of this, I am very cautious about putting a ton of money to work at any one time but am willing to add to a position if it starts to work out in my favor. We do not have enough clarity right now to get overly excited in one direction or the other, so it is simply a matter of waiting for momentum to come back into the market. Until then, I would be very cautious, but I would also keep an eye on the 10-year yields in the United States, because that could be a major determining factor as the negative correlation is rather strong.