With the energy crisis plaguing the British economy, the British pound remained lower than the rest of the other major currencies. The GBP/USD currency pair fell to the support level at 1.3411 in the last trading sessions, and while it tried to recover, he rebound gains did not exceed the resistance level of 1.3648. The pair fell yesterday to the 1.3544 support before it setlled around 1.3600 as of this writing, awaiting stronger catalysts.

The US dollar is still the strongest beneficiary in the Forex trading market from the global energy crisis. The US economic performance is strong, and expectations are that a tightening of the Federal Reserve's policy is at hand, which supports the US dollar. With markets cautiously anticipating tomorrow's US jobs numbers, Viktor Golovchenko of ThinkMarkets believes the dollar's dominance will extend, regardless of the non-farm payroll release.

He sees that the only possible turning point for the dollar is the November Federal Policy Update, when they are expected to announce a cut in quantitative easing. He stated, “We expect the strength of the US dollar to continue at this meeting and may begin to taper off after the news is finally released. And the ECB and BoE shouldn't take long after the Fed's move, and a repricing of that could catch dollar bulls on the long side.”

The analyst sees a fairly strong rally over the next month, with November likely to be neutral, and a full reversal to follow towards the end of the quarter as other central banks become more hawkish.

However, with the Bank of England likely to raise interest rates in early 2022, some of the negative damage to the GBP/USD exchange rate may be limited. Indeed, the pound maintains its position as one of the best performers for 2021, thanks in part to expectations of higher interest rates at the Bank of England. The British government has also committed to a "high wage" future, with British Prime Minister Boris Johnson saying restrictions on unskilled immigration will force companies to invest in the productivity of their employees.

Media reports also indicate that the government will soon announce another minimum wage increase, almost certainly in the fall budget.

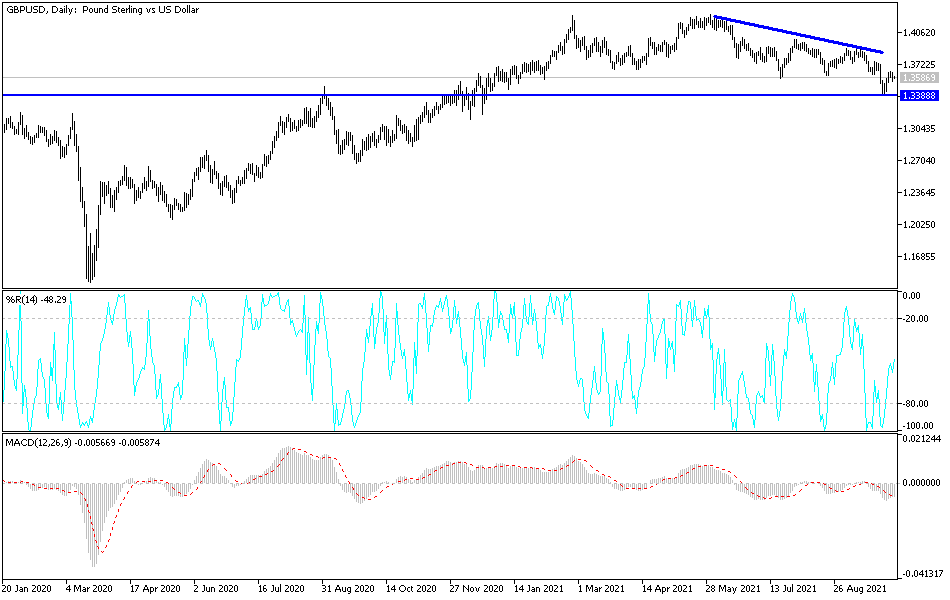

Technical analysis of the pair

On the daily chart, the GBP/USD currency pair is still within a bearish channel. Despite the recent rebound attempts, the bulls are waiting to break through the 1.3885 resistance to change the general trend to the upside instead of the current bearish outlook, which may push the currency pair towards the 1.3520, 1.3410 and 1.3340 support levels. It is worth noting that the movements of the GBP/USD in the coming days are contingent on the easing of the energy crisis in Britain and the return of the strength of the British economic performance, which motivates the Bank of England to make decisions, in addition to the lull in the Brexit negotiations.

The pound is not awaiting important any British economic data today. From the United States, the weekly US jobless claims will be announced.