The GBP/USD was sold off at the end of last week, pushing the pair to the 1.3736 support level, and then rebound gains pushed it towards the 1.3835 resistance level, its highest in a month. Nevertheless, the pound still has the opportunity to recoup its losses quickly. Sterling is holding onto gains especially after BoE's Huw Pill comments boosted expectations for a rate hike in November, while progress towards a final agreement on Northern Ireland was also reported.

The Bank of England's new chief economist warned that inflation would smash their current expectations and that the possibility of a November rate hike was therefore under 'live' consideration. In an interview with the Financial Times, Bell said inflation was likely to rise "close to or even slightly above 5%". Urging the possibility of a November rate hike, Bell said that it was "perfectly balanced," and that November is an "opportunity."

Sterling got more support in 2021 from expectations that the Bank of England will be among the first to raise interest rates among the world's major central banks. Those expectations still stand, giving the British pound momentum against the other major currencies. "The big picture, I think, is that there are reasons we don't need the emergency policy settings that we saw after the pandemic intensified," the BoE governor said, "and the settings we have now are supportive. The need for support has diminished, as the bridge has been built and largely crossed.”

In August, the bank raised peak inflation in the UK to 4.0%, but the scale of cost pressures affecting the economy surprised economists. In this regard, Alan Job, CEO of consumer goods giant Unilever, said that the company was facing “an inflation scenario once every two decades, so we escalated prices.” Ian Wright, chief executive of the Food and Beverage Federation, told lawmakers last week that inflation in the hospitality sector had reached 18% as companies faced rising wages, energy costs and goods.

Wright told the Business, Energy and Industrial Strategy Committee: “In the hospitality sector, which is a harbinger of retail trade, inflation is between 14% and 18%. This is terrifying.”

Bank of England Governor Andrew Bailey has emphasized on several occasions now that his fear is that inflation caused by external factors - such as energy costs - could affect other areas of the economy. Accordingly, Andrew Goodwin, chief UK economist at Oxford Economics, says: “More hawkish interventions from MPC members have put more emphasis on the possibility of an early rate hike.” It would have done limited damage.”

Money markets are now pricing in a November rate hike, although recent economic data have been somewhat mixed. Accordingly, Fabrice Montagni, an economist at Barclays, says: “We can assume that the BoE is ready to raise regardless of the data in the early stages of its cycle. Therefore, although we continue to believe that risks are overly skewed to the weak side, our current call will be led by MPC data.”

Barclays expects the first rate hike to come from the Bank of England in December, which Oxford Economics also expects.

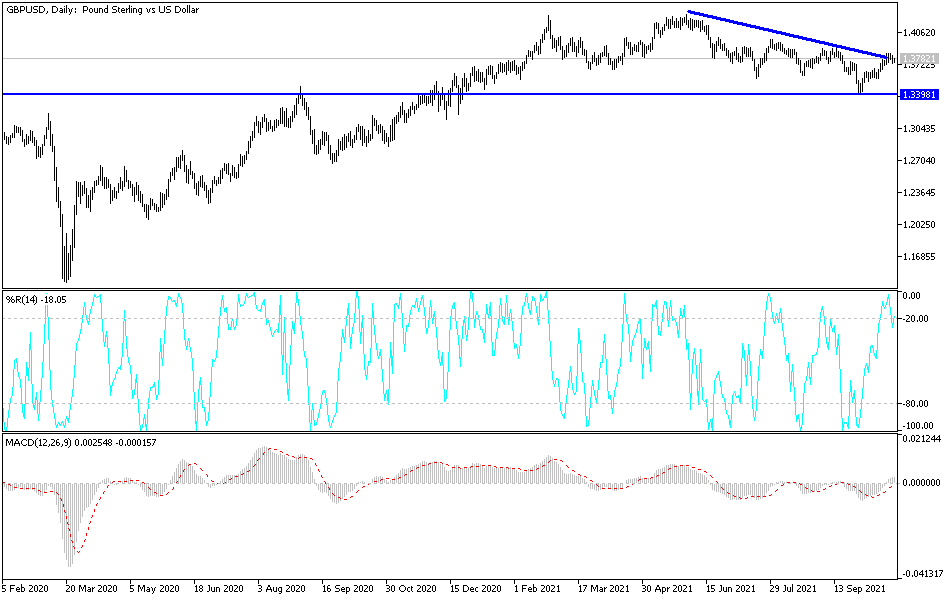

Technical analysis of the pair

In the near term, and according to the performance on the hourly chart, it appears that the GBP/USD is trading within a descending channel formation. This indicates a significant short-term bearish momentum in market sentiment. Therefore, the bears will look to ride the current trend towards 1.3737 or lower to 1.3715. On the other hand, the bulls will target potential bounces around 1.3779 or higher at 1.3802.

In the long term, and according to the performance on the daily chart, it appears that the GBP/USD is trading within the formation of a sharp bullish channel. This indicates a significant long-term bullish momentum in market sentiment. Therefore, the bulls will look to extend the current gains towards the 1.3851 resistance or above to the 1.3953 resistance. On the other hand, the bears will target long-term profits around the 1.3660 support or lower at the 1.3549 support.