The GBP/USD has been sold off for 3 session in a row, with its correction attempts stopped at the 1.3736 support and settling around 1.3770 as of this writing. The pound still has a chance to rise with expectations of the Bank of England tightening its policy and a breakthrough in the energy crisis in the country, which caused strong losses for the pound against the rest of the other major currencies. Today there are no major reports due from the British economy, although it is worth noting that the Bank of England is under pressure to raise interest rates in order to keep inflation in check. The risk of stagflation is strong in the UK, where growth remains subdued while price pressures rise.

Meanwhile, the US dollar could take cues from the release of advanced US Q3 GDP and core PCE Price Index due later in the week. A weaker growth figure of 2.6% is seen after the economy recorded 6.7% growth in the previous period. GDP models such as that of the Federal Reserve Bank of Atlanta predict weaker growth of 0.5%, so a negative surprise may be possible.

The core PCE Price Index - the Fed's preferred measure of inflation - may also register a slightly slower increase in price levels of 0.2% versus the previous gain of 0.3%, which could dampen the Fed's hardened hopes by mid-2022. On the other hand, a stronger-than-expected reading could bring a lot of upside for the dollar as it may convince the Fed to raise early.

Commenting on the future performance of GBP/USD, Juan Manuel Herrera, strategist at Scotiabank, said, “The short-term trend remains positive but intraday signals point to a potential reversal at depth of 1.37 and the GBP failed to make much beyond the 100-day moving average (today at 1.3801) and since the middle of the year. Support is at 1.3770/75 followed by 1.3743 and the 50 day moving average at 1.3713. The odds are skewed towards the BoE's action in its November meeting with the bank's chief economist, Pell, describing the meeting as 'live' in an interview with the Financial Times."

But the markets may check their expectations on how much the BoE in the short term may raise even further. So Scotiabank's Herrera and colleagues said that GBP/USD gains in the direction of 1.40 will require more hawkish guidance forward.

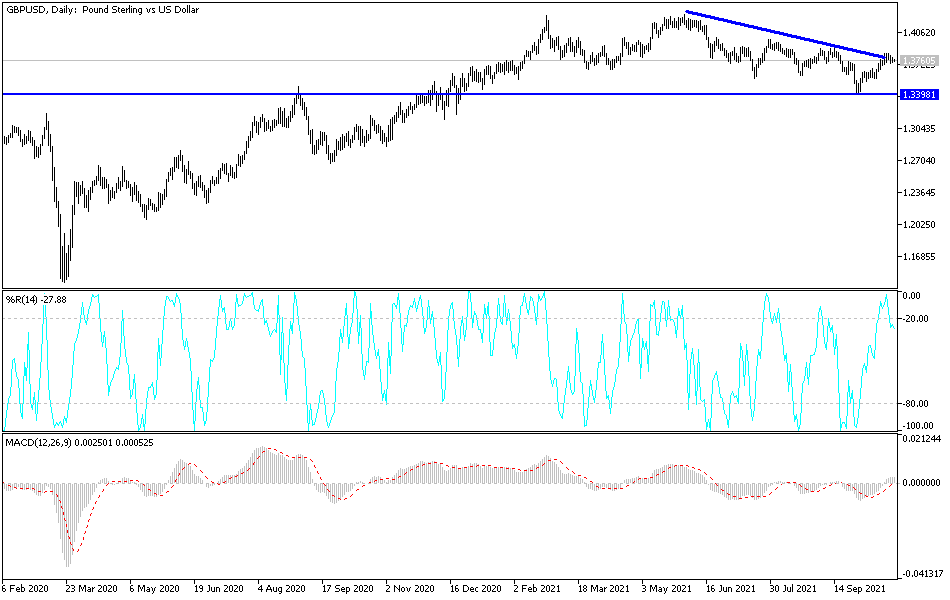

Technical analysis of the pair

The GBP/USD has recently bounced off its support range at 1.3740 and appears to be making its way to the top at 1.3830. Technical indicators support the continuation of the rebound. So far, the 100 SMA is still above the 200 SMA to confirm that the general trend is still bullish and that the support is more likely to hold than break. The 200 SMA lines up with range support to add to its strength as a floor, but the pair is moving below the 100 SMA which could hold as dynamic resistance near 1.3800.

The stochastic has room to rise before reaching an overbought area to indicate exhaustion among buyers. This indicates that the price may continue to rise before the sellers take over. The RSI also has room to move higher, so the GBP/USD can follow suit until the overbought conditions are met.