The GBP/USD settled higher around the 1.3780 resistance level as of this writing, thanks to a halting of the US dollar’s gains, expectations of the Bank of England tightening policy and dissipating fears about the energy crisis. This rebound will coincide today with new statements from the governor of the Bank of England, and then the announcement of US housing numbers.

The GBP/USD made a strong recovery from September's losses and may rise further this week in recognition of the increasingly "hard" BoE policy stance, although any move above the 1.38 resistance may be difficult to sustain due to the resilience of the dollar. An important factor for the pound's recovery against the dollar was the Bank of England's rapid shift to a more "hawkish" stance on inflation and interest rates, which will again be in focus this week following Governor Andrew Bailey's comments on Sunday.

Bank of England Governor Bailey said in a statement: “As I have said before, monetary policy cannot solve supply side problems, but it will and should act if we see a risk to medium-term inflation and especially medium-term inflation expectations.” His comments were contained in a panel discussion at the 36th Annual International Banking Symposium of the Group of Thirty on Sunday. Governor Bailey told panelists and the public that recent spikes in inflation are still likely to be short-lived because the underlying causes — such as changes in commodity prices and other costs from supply chain disruptions — are themselves temporary.

But he also acknowledged that the recent increases in energy prices, which include a 165% rise in natural gas prices for the quarter ending in mid-October, could mean inflation will remain at abnormally high levels for longer than previously expected and may eventually necessitate a response from the Bank of England.

The FX market has been slow to recognize the risk that the BoE could start reversing the 2020 bank rate cuts anytime over the coming months, but Sunday's comments were the most frank yet and left no room for further confusion. Commenting on this, Robert Wood, British economist at BofA Global Research says: “We believe the Bank of England will judge that a 15 basis point rate hike in the near term, while raising rates to 0.25%, will do little to damage growth, but it will indicate to his interest in inflation."

“We chose the December increase because the Bank of England would have October labor market data at that point, and Saunders noted December rates,” Wood and colleagues wrote in a research briefing late last week.

With abnormally high inflation likely to persist for longer than previously envisaged, the Bank of England recognizes that it could affect the intentions of setting prices for companies and wage requirements for workers in a way that risks creating a self-cycle of above-target inflation outcomes. Governor Bailey also added: "That is why we have indicated in the Bank of England - another such signal - that we will have to act."

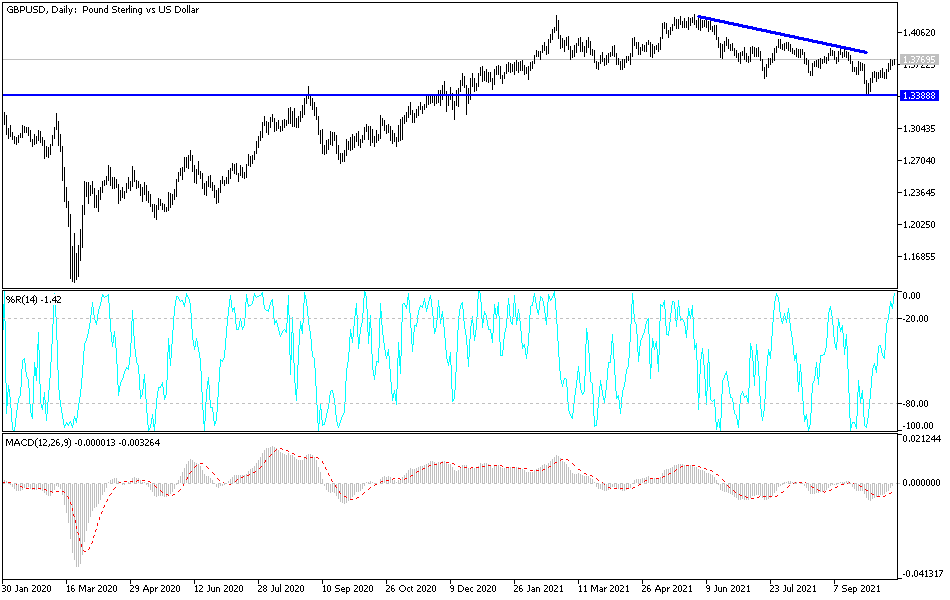

Technical analysis of the pair

The current rebound of the GBP/USD succeeded in breaking through the descending channel. To really make the trend bullish, the pair will have to break through the 1.4000 psychological resistance again, which may happen if it moves towards the 1.3845 resistance first, because it will increase buying. On the other hand, moving downwards towards the support level 1.3585 again will be a strong support for the bears to control the general trend again.

The performance of the GBP/USD will remain dependent on risk appetite, as well as the reaction to the energy crisis in Britain and the future monetary policy of both the US Federal Reserve and the Bank of England.