Immediately after the British government announced several measures to reduce fears regarding the country's energy crisis, the performance of the pound improved against the rest of the other major currencies. The GBP/USD moved towards the 1.3640 level, after sharp losses that pushed it last week to the support level of 1.3411, a 2021 low.

The pound has rebounded sharply from its 2021 lows, but the previous declines were technically significant and analysts warned that further losses could be seen in what is a defining week for the Fed's monetary policy outlook. Disruptions in the UK's fuel supply and significant increases in natural gas prices in international markets have led many observers to suggest that the UK may be heading for a period of economic "stagflation".

Commenting on the performance, Michael Cahill, Forex analyst at Goldman Sachs wrote, “The pound tends to underperform in this type of scenario, but it is rarely sustained, and there are fundamental reasons to be skeptical about the prospects for prolonged stagflation.” The losses came along with a broad rally in the dollar and a sharp drop in international stock markets, but nearly half of the pound's decline was reversed in a recovery on Thursday and Friday which enabled the pound to open the new week higher near 1.3550.

The recovery came after the Office for National Statistics announced a major upward revision of its estimates for second-quarter economic growth on Thursday, boosting bets in money markets that the Bank of England (BoE) may begin to gradually roll back last year's interest rate cuts over the coming months. There is room for this rebound to continue this week if the BoE's policy outlook puts an additional supply on the pound or if market appetite for the dollar wanes ahead of the September US non-farm payrolls report on Friday, with implications for the Fed's policy outlook.

Commenting on the performance of the GBP/USD pair, Francesco Pesol, an analyst at ING Bank said: “For the short term, we tend to favor the dollar (sterling doesn't like risk aversion) and technically there is a case for a multi-day move in sterling to the 1.32 support. And resistance at 1.3570/1.3620 should now be tough to break to the upside.”

“The market may need to consolidate its recent losses in the near term,” says Karen Jones, Head of Technical Analysis for Currency, Commodities and Bonds at Commerzbank. “GBP/USD has recently eroded its 1.3515/04 Jan 2009 low and 2019 high, which represents a major breaking point for the market. And the close below here presents a range for the 200-week average at 1.3160.”

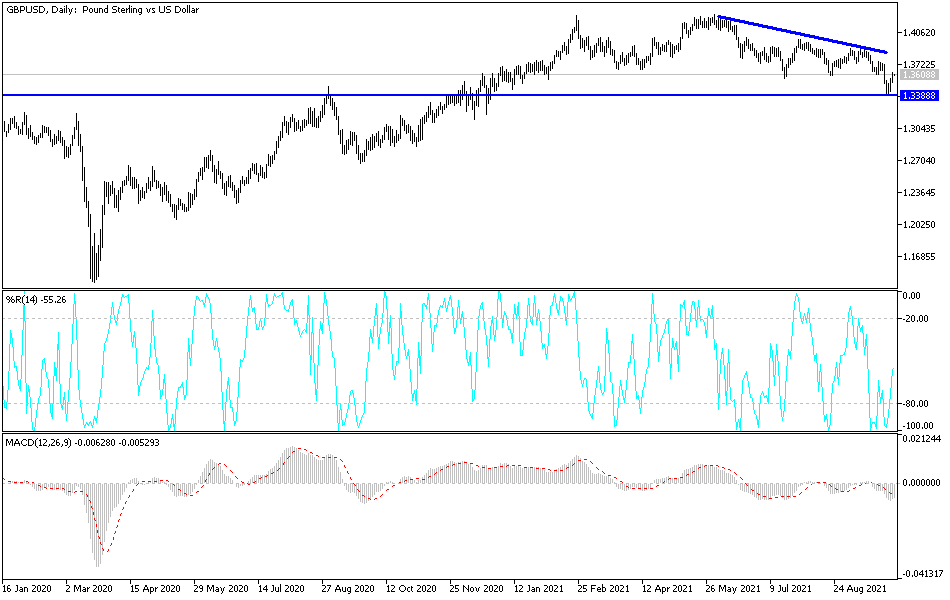

Technical analysis of the pair

On the daily chart, the GBP/USD currency pair is still under downward pressure. It's starting to form an ascending channel but needs more momentum, which may be achieved if the currency pair moves towards the resistance levels at 1.3750 and 1.3900. Otherwise, the general trend of the pair will remain bearish, and breaching the 1.3575 support once again will move the pair towards stronger bearish levels.

The currency pair will remain dependent on market sentiment regarding a solution to Britain's energy crisis and the reaction to the announcement of US jobs numbers this week, which will have a strong impact on expectations of the future of US monetary policy tightening. Today, the PMI reading for the services sector will be announced in Britain and the United States of America.