The GBP/USD tried to complete the upward recovery path from the end of last week’s trading, reaching the resistance level 1.3673. But as traders focused once again on a possible tightening of the Fed’s policy, they returned to buying the US dollar at the expense of the other major currencies. The energy crisis in Britain is still ravaging the gains of the pound, which is stable around the 1.3590 level as of this writing.

The recent strong corrective performance of the pound may be supported by the positive shift in the policy stance of the Bank of England (BoE). The weekend's cues from the BoE did little to discourage the market from the idea that the BoE could start reversing last year's interest rate cuts any time in the coming months - although unlikely before early 2022 - to reduce inflation risk that exceeds the 2% target for too long.

This idea explains the recovery of the GBP/USD from its lows in late September near 1.34 to around 1.3650 yesterday, although this recovery is far from certain, as the pound will be sensitive this week to key economic figures from the UK, in addition to the potential implications of the statements from several BoE policymakers who are considered among the most "pessimistic" on the Monetary Policy Committee (MPC).

BoE Deputy Governor John Cunliffe and MPC members Silvana Tenreiro and Catherine Mann, three members who may be the closest BoE MPC members to a "peaceful camp", will offer their views on monetary policy this week and sterling will be sensitive to them. Commenting on the future of central bank policy, Joseph Caporso, head of international economics at the Commonwealth Bank of Australia, says: “We expect the US Federal Reserve, the Bank of England (BoE) and the Bank of Canada (BoC) to begin their policy tightening cycles in 2022.”

The risk this week is that Wednesday's US inflation numbers and the minutes of the Fed's last meeting in September serve as a reminder that a major shift in US monetary policy is imminent and that the bank may surprise once again on the urgent side of expectations.

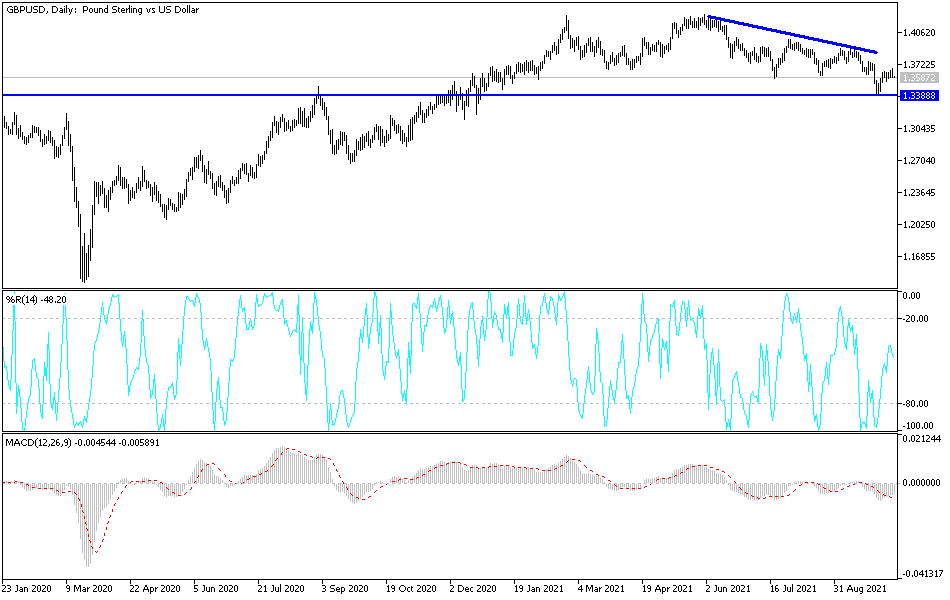

Technical analysis of the pair

There are technical warnings that the GBP/USD currency pair will be subject to new losses that may eventually bring it back to its lowest levels since November 2020, around 1.3161, if the GBP/USD price is unable to recover above 1.3914 in the medium term. However, the pound seemed reluctant to let go of the 1.3550 level last week and could get further support from the notes that the three BoE policy makers will make as they speak as part of this week's public engagements or from key UK economic numbers due in the coming days coming.

The British pound will be affected today by the announcement of the details of the jobs report in Britain, which includes the unemployment rate, average wages and the rate of change in employment. The US dollar will be affected by statements from US monetary policy officials.