At a good and steady pace, the GBP/USD is moving in a correctional range, hitting the 1.3834 resistance before settling around 1.3785 as of this writing. The British pound has returned to its most recent 20-month highs against the and a one-month high against the dollar. The advance came against the backdrop of broadly supportive global investor sentiment and the expectation of higher interest rates in the UK.

The pound sterling is a currency that tends to benefit when stock markets are rising and global investors are in a risky mood, and the euro and dollar tend to benefit when the opposite is true. As long as markets continue to recover from their September slump, sterling's weakness may be superficial.

The UK's strengthening of the pound comes as traders are betting that the Bank of England will raise interest rates from record lows in November.

Commenting on the performance, Fouad Razakzadeh, market analyst at ThinkMarkets.com, said: "The sterling crosses continue to shine bright as investors increase their expectations of an imminent rate hike in the UK." BoE Governor Andrew Bailey said at the weekend that the bank "will have to act" to curb inflationary pressures.

The possibility of a higher bank rate could raise the cost of borrowing through the economy, increasing the return on UK debt financial assets that attract foreign investor capital. Razakzadeh adds that the best gains in sterling will be observed against currencies where the central bank is still quite pessimistic, such as the yen and the franc. He added, “Although the GBP/JPY has already risen sharply, the GBP/CHF has not made its move yet and seems to be just starting to prepare. Like the Bank of Japan, the Swiss National Bank is nowhere ready to tighten monetary policy. And if anything, he keeps warning that the franc is still overvalued.”

Some Forex analysts have expressed doubts about whether recent gains in the British pound can be extended on a sustainable basis, warning that the time may in fact be a good time to sell the currency. From the critics' point of view, higher UK interest rates will slow growth further and contribute to an environment of high inflation and stagnant growth, which is not supportive of the GBP.

A number of economists have come out to warn that raising interest rates when growth slows will only exacerbate the slowdown, leaving the Bank of England guilty of miscalculation. Some FX analysts are increasingly tempted to this line of reasoning to justify calling for pound weakness in the future, warning that recent gains are unlikely to be sustained. Interest rates are currently at a historic low of 0.1% but economists warn that inflation could be on track to peak at 6.0%, which in itself could be devastating.

So the BoE feels that it should be seen as acting on inflation.

Former MPC member Andrew Sentence was critical of Blanchflower's view, saying: "How can we take Danny Blanchflower seriously? UK inflation heads to 6 per cent and urges interest rates to be kept at a record low of 0.1 per cent."

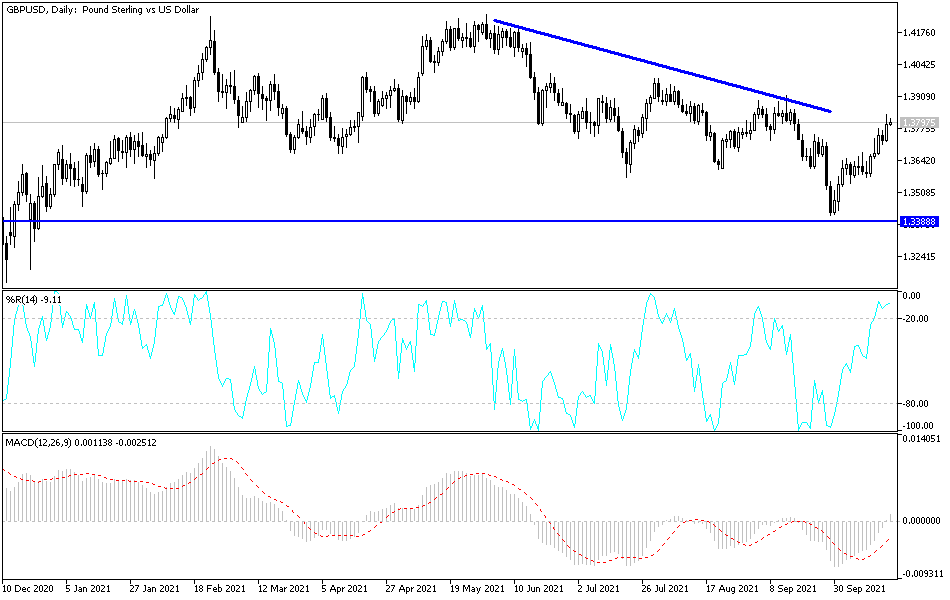

Technical analysis of the pair

On the daily chart, the GBP/USD pair is moving within an ascending channel that was formed recently, and the general trend will turn to the upside by testing the psychological resistance 1.4000. Moving above the 1.3880 resistance will support a move to there. Over the same time period, the bears will regain control of the trend if the currency pair returns to the 1.3580 support level.

The currency pair will be affected today by the announcement of inflation figures in Britain and the path of global financial markets towards risk appetite, as well as expectations of the future of monetary policy tightening by both the Bank of England and the US Federal Reserve.