The GBP/USD tried to rebound higher last week, but its gains did not exceed the 1.3658 resistance and it closed trading stable around 1.3617. The energy crisis in Britain negatively affects the sentiment of investors about the economic recovery of the markets, after the country abandoned all COVID restrictions. This crisis was enough to push the GBP/USD towards the 1.3411 support level at the end of last month, which is the lowest level for the currency pair for 2021 so far.

On the economic side, the GBP/USD currency pair is influenced by the disappointing non-farm payrolls results in the US with 194K jobs added compared to the 500K jobs expected in the non-farm sector. On the other hand, the nation's unemployment rate for September beat expectations of 5.1% by a rate of 4.8% down from 5.2% in August, while the average weekly wage growth rate was in line with the (annual) estimate of 4.6%. .

UK house prices, according to Halifax data, for the three months ending in September beat expectations (annually) by 4.9% with a change of 7.4%, while the change (monthly) for September exceeded 0.8% by 1.7%. Before that, it was announced that the British Manufacturing PMI for the month of September fell below expectations of 54 with a reading of 52.6, while the Services PMI beat expectations of 54.6 with a reading of 55.4.

More energy suppliers are likely to collapse as a result of the recent extreme volatility in gas markets, the latest sign of the worsening crisis in the UK.

Ten companies have already failed since the beginning of August and the exodus is not over yet, according to British Business Secretary Kwasi Quarting. The sharp rise caused by concerns about the availability of winter supplies triggered huge price swings that sent gas prices in the Netherlands and the UK up 60% in just two days before dropping.

The British grid operator has tried to calm the market, saying its model shows the nation will be able to secure enough gas. The minister said at the energy industry meeting that consumers need to continue to be protected from "exorbitant price hikes" in the natural gas markets. "It's going to be a very tough time."

The official added that the regulator Ofgem is currently looking for new suppliers for clients of failed companies, a tool that is working effectively. But there are signs that the system is under pressure, with major suppliers warning that they have reached the limit of their ability to deal with losing customers. For his part, Jonathan Brierley, CEO of Ofgem, said at the same conference in London that the significant upward pressure on gas prices is likely to continue and that the market needs to prepare for more shocks. He said the crisis shows that the energy market will need a different regulation in the future.

The government also said the UK price cap, a limit on default tariffs for households, would remain in place. One analytics firm warned that this could increase by 30 percent in the next account due to be announced in February, adding pressure on household budgets.

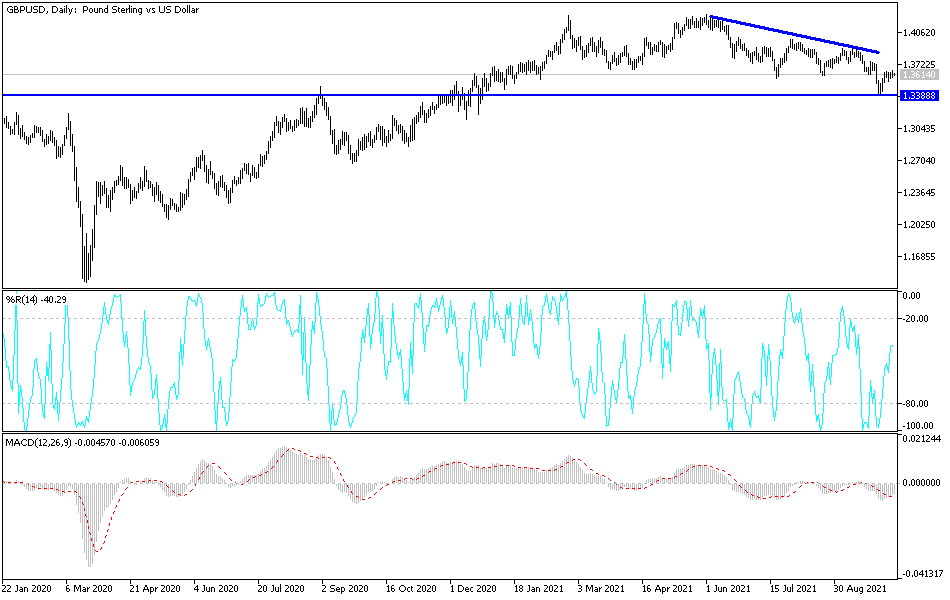

Technical analysis of the pair

In the near term, and according to the performance on the hourly chart, it appears that the GBP/USD is trading within the formation of an ascending channel that needs momentum. This indicates a slight short-term bearish momentum in the market sentiment. Therefore, the bulls will look to extend the current gains towards 1.3641 or higher to 1.3673. On the other hand, the bears will target potential pullbacks at 1.3577 or lower at 1.3544.

In the long term, and according to the performance on the daily chart, it appears that the GBP/USD is trading within the formation of a descending channel. However, the currency pair has rebounded recently to avoid sliding into the oversold levels of the 14-day RSI. Therefore, the bulls will look to swoop in for long-term profits around 1.3733 or higher at 1.3858. On the other hand, the bears will target the extension of losses to the support levels 1.3482 or lower at 1.3356.