The GBP/USD pair's bullish attempts to complete its ascending channel lacks strong momentum, which explains the recent performance of the currency pair, which has settled around the 1.3725 support level. This performance can be linked to expectations of lower government borrowing requirements in the coming years. The cost of government bond financing has fallen in the wake of the budget announcement. The UK 10-year government bond yield fell by 10 basis points to 1.003%.

It was the biggest one-day drop since March 2020 and is linked to a combination of low inflation expectations and the belief that the UK government will not be required to issue as much debt as previously expected. A lower supply of bonds issued to finance borrowing means higher bond prices, all equal, as investors chase a limited supply. Given that yields move in the opposite direction of bond prices, the net result is lower bond yields.

International investors tend to chase higher yielding bonds, providing a source of support for the local currency. Therefore, the decline in British 10-year bond yields is depriving the British pound of gains. However, the shortfall in long-term bonds in the coming years cannot be ignored as British Chancellor of the Exchequer Rishi Sunak said he has put in place two new fiscal rules in order to maintain fiscal discipline:

1. Public sector debt should be reduced as a percentage of GDP

2. The state will only borrow for investment

Therefore, the books must be balanced for daily spending and investors see the possibility of more limited debt issuance by the treasury. Sunak also said that in normal times, the country would have to invest only for future growth and prosperity, while facing daily spending through taxes.

Although borrowing will be less over the coming years, a review of budget and spending revealed that each individual administration would see a real increase in total spending for this Parliament as total spending would increase by £150 billion, the "largest increase in a century". Thus spending will grow by 3.8% in real terms. The Office of Budget Responsibility (OBR) - the independent body that provides the Treasury with economic forecasts from which decisions can be made - expects the UK's economic recovery to be faster than thought in March. They raised their 2021 growth forecast from 4% to 6.5%. The British economy is expected to grow by 6% in 2022 and unemployment is expected to peak at 5.2%.

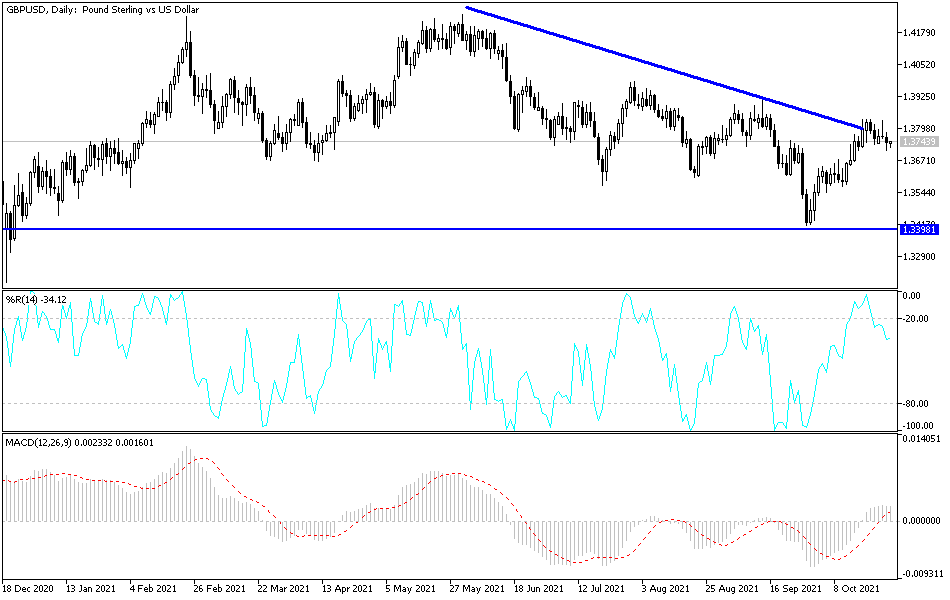

Technical Analysis

On the daily chart, the GBP/USD is still in an initial stage to exit the bullish channel, which pushed it towards the 1.3845 resistance level during this month’s trading. Bulls were aspiring to get to the psychological resistance at 1.4000, but the dollar strengthened on expectations of imminent tightening of monetary policy and stronger than expected results for the US economy, which confirm the possibility of this happening. The bears are eyeing the support levels 1.3685, 1.3600 and 1.3525, which are sufficient levels to reverse the general trend to the downside.

The GBP/USD will be strongly affected today by the announcement of the growth rate of the US economy, the number of US weekly jobless claims and pending home sales.