Bullish View

Buy the GBP/USD and add a take-profit at 1.3900.

Add a stop-loss at 1.3750.

Timeline: 1-2 days.

Bearish View

Set a sell-stop at 1.3800 and add a take-profit at 1.3700.

Add a stop-loss at 1.3900.

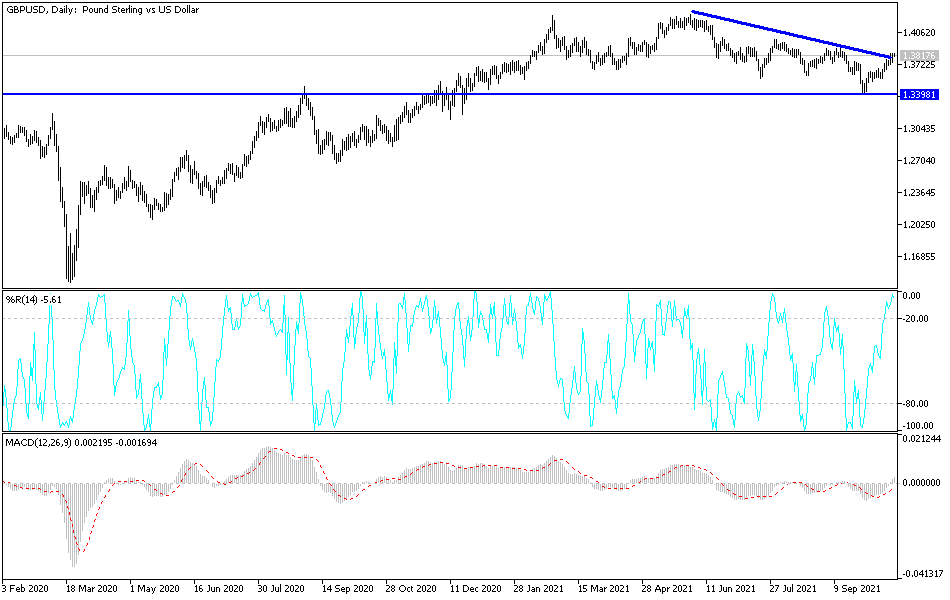

The GBP/USD price jumped to the highest level since September 16 as investors focused on the relatively weak US dollar. Sterling also rose even after the UK published the relatively weak consumer inflation data on Wednesday. It is trading at 1.3825, which is about 3.12% above its lowest level this year.

UK Inflation and Weak US Dollar

A core theme in the market this week has been the relatively weaker US dollar. The US Dollar Index has declined substantially and is currently trading at its lowest level since September 28. It has fallen by more than 1% this year.

The losses continued on Tuesday after the US published weak housing starts and building permits data. It has also declined at a time when many American companies like Tesla and Netflix have released strong earnings data.

The GBP/USD will react to the latest Philadelphia Manufacturing Index data. Economists polled by Reuters expect the data to show that the index declined from 30.7 in August to 25 in September as costs of doing business rose. The US will also publish the latest initial and continuing jobless data.

Meanwhile, in the UK, there are concerns that the Boris Johnson administration will impose new lockdowns as the number of Covid cases and deaths increase. In a statement on Tuesday, an influential group of NHS practitioners asked the administration to implement new lockdowns. A return to lockdowns would hurt the economy substantially.

The GBP/USD also rose after the latest UK inflation data. On Wednesday, data by the Office of the National Statistics (ONS) showed that the headline consumer inflation declined from 0.7% in August to 0.3% in September. On a year-on-year basis, prices fell from 3.2% to 3.1%. Still, analysts expect that inflation will start rising due to the ongoing energy crisis.

GBP/USD Forecast

The hourly chart shows that the GBP/USD pair has been in a strong bullish trend lately. The pair’s bullish trend is being supported by the ascending trendline shown in black. It has also moved above the key support level at 1.3750, which was the highest level on September 23rd. The pair also rose above the 25-day and 50-day moving averages.

Therefore, the pair will likely keep rising as bulls target the next key resistance level at 1.3900. On the flip side, a drop below the key support level at 1.3750 will invalidate the bullish view.