Bearish View

Sell the GBP/USD and set a take-profit at 1.3400 (S1).

Add a stop-loss at 1.3645.

Timeline: 1-2 days.

Bullish View

Set a buy-stop at 1.3610 and a take-profit at 1.3700.

Add a stop-loss at 1.3500.

The GBP/USD pair declined in the overnight session as the US dollar rally accelerated. The pair declined to 1.3550, which was about 0.65% below the highest point this week.

US Jobs Numbers Ahead

The biggest catalyst for the GBP/USD is the upcoming jobs numbers from the United States that will come out on Friday. Before then, the ADP Institute delivered its estimate for these numbers on Wednesday. The data revealed that the American private sector added more than 543k jobs in September as the recovery continued.

Later today, the US will publish the latest initial and continuing jobless claims numbers. They will be followed by the official jobs numbers on Friday. The data is expected to show that the economy added more jobs in September than in August while the unemployment rate declined to 5.1%. Similarly, wages are expected to have risen by more than 4.6%.

The GBP/USD also declined because of the overall stronger US dollar as worries of stagflation continued. The price of crude oil has jumped to the highest level in more than 7 years while coal and natural gas prices have surged to an all-time high.

Therefore, since energy is the biggest component of inflation, analysts believe that it will overshoot the BoE estimate of 4%. Some analysts expect that the UK inflation will rise to 6% in the coming months while others see the Retail Price Index soaring to 7%. That will be the highest figure since the 1990s.

Later today, the GBP/USD pair will react to the latest UK Home Price Index by Halifax. Analysts expect the data to show that home prices continued the upward momentum in September. In total, home prices have risen by more than 20,000 pounds during the pandemic. Therefore, there are concerns that the Fed and BoE will start tightening sooner than expected.

GBP/USD Forecast

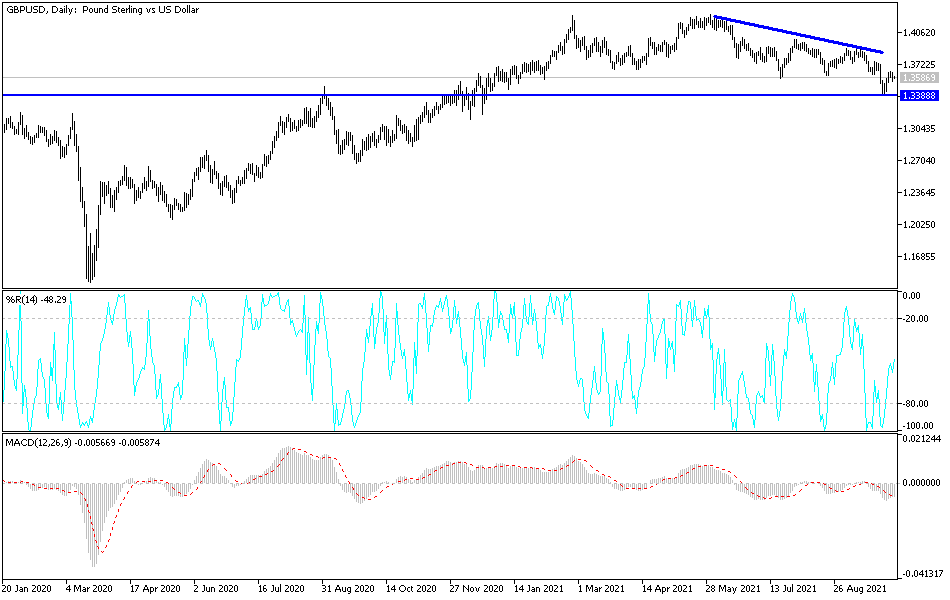

The four-hour chart shows that the GBP/USD pair declined sharply as fears of stagflation rose. The pair fell to a low of 1.3550, which was along the standard pivot point. It also moved slightly below the 25-day moving average while the MACD has formed a bearish crossover.

Therefore, the pair will likely keep falling today as bears target the first support of the pivot point at 1.3400. On the other hand, a move above 1.3650 will invalidate this view.