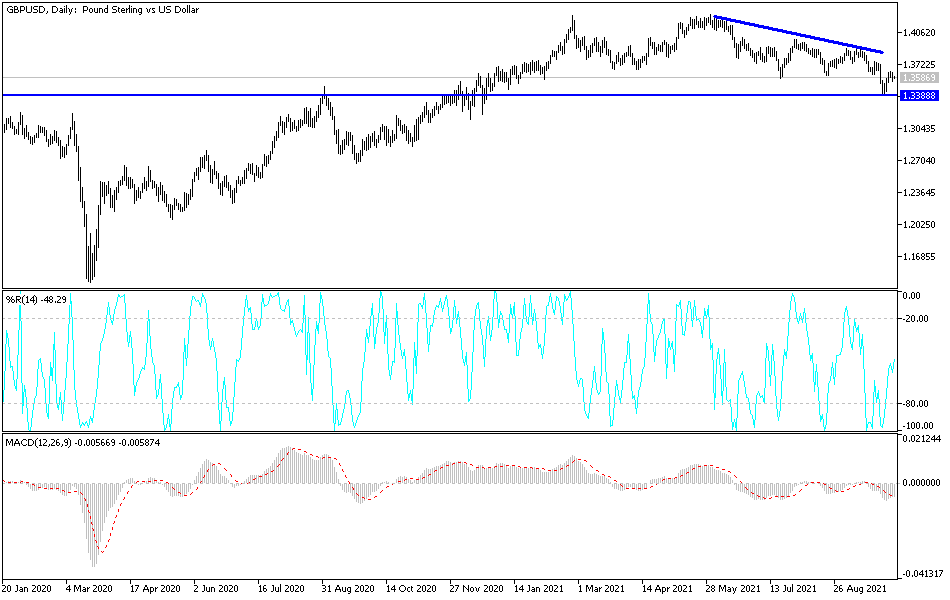

The British pound fell bit on Wednesday as we bounced enough to test the bottom of the previous triangle. The descending triangle was a very negative sign, and now that we have retested this area, it is likely that we will continue to see selling pressure. If we can break down below the bottom of the candlestick for the trading session on Wednesday, then I think that will allow the market to go looking towards the 1.35 handle next. After that, then we would go looking towards the 1.34 handle.

The British pound has been suffering at the hands of the US dollar for a while, and I think that will continue to be the case going forward, mainly because the United Kingdom is having major energy issues, which obviously does nothing good for an economy. Beyond that, interest rates in the United States have been rising, so it does make the US dollar, or at least the bond market in America, much more attractive than money flowing into the United Kingdom.

Beyond that, we also have a massive selloff that had occurred at the 1.37 handle, which is also the scene of the 200-day EMA and likely to see the 50-day EMA cross below there, forming the so-called “death cross.” At this point, longer-term traders will be looking closely at this signal as a potential selling opportunity, so I do think that we will have a lot of noise just above. That being said, you also need to pay close attention to the fact that Friday is the non-farm payroll number in the US, which will have a major influence on what happens next with the greenback.

We are making a series of “lower highs” and “lower lows.” That is, by its very definition, considered to be a downtrend, and unless we break some type of structure to the upside, I just do not see me going long at this point. The 1.39 level above is an area that has shown resistance previously, so breaking above that would obviously be a very strong turnaround and could send the British pound looking towards 1.42 handle afterwards. I do not necessarily think that is going to happen, but it is the outlying possibility that you need to keep in the back of your head.