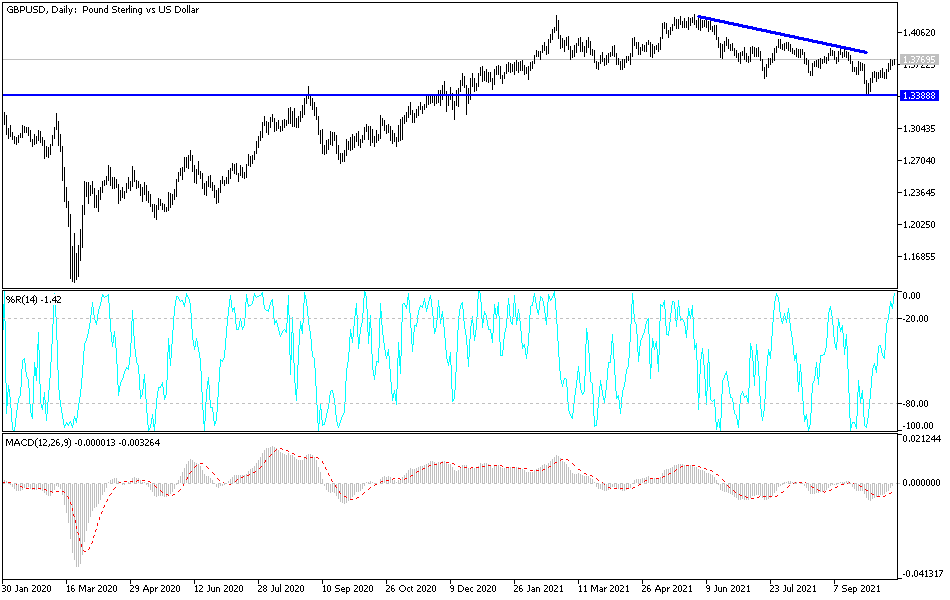

The British pound initially sold off on Monday but then turned around to show signs of life again as we bounced from both the 50-day EMA and the 1.37 level. The 1.37 level has been important more than once, so it is likely that we will continue to see it cause a bit of a reaction. The shape of the candlestick is a hammer, so I think at this point if we break above the highs of the Friday session, we will have cleared that downtrend line and should go looking higher at that point as it would be a significant breakout.

If we were to turn around and break down below the bottom of the candlestick for the trading session on Monday, then it is very likely we would go looking towards the 1.3650 level, and then maybe even the 1.36 level. Anything below the 1.36 level would be extraordinarily negative and could send this market much lower. The US dollar is sufficiently bearish in the short term to continue to push this market to the upside, and it should be noted that the Bank of England is very likely to raise interest rates this year, which makes the British pound much more attractive. There has been a major move in the British bond market, and that suggests that traders are trying to get ahead of the Bank of England. This is expressed in the currency market as well, so it will be interesting to see if there is any follow-through.

If we do break out above the candlestick from the Friday session, that is very likely we would go looking towards the 1.39 handle, and then maybe even the 1.40 handle. The 1.40 handle is a large, round, psychologically significant figure, and then possibly the 1.42 handle. I do believe it is very likely that we will continue to see buyers jump into this market based upon value, unless we get that breakdown below the 1.36 handle like I mentioned. Ultimately, I do think that this is a market that is going to show volatility, but it clearly is starting to show momentum to the upside. The failed “death cross” now suggests that the buyers have really started to ratchet up momentum.