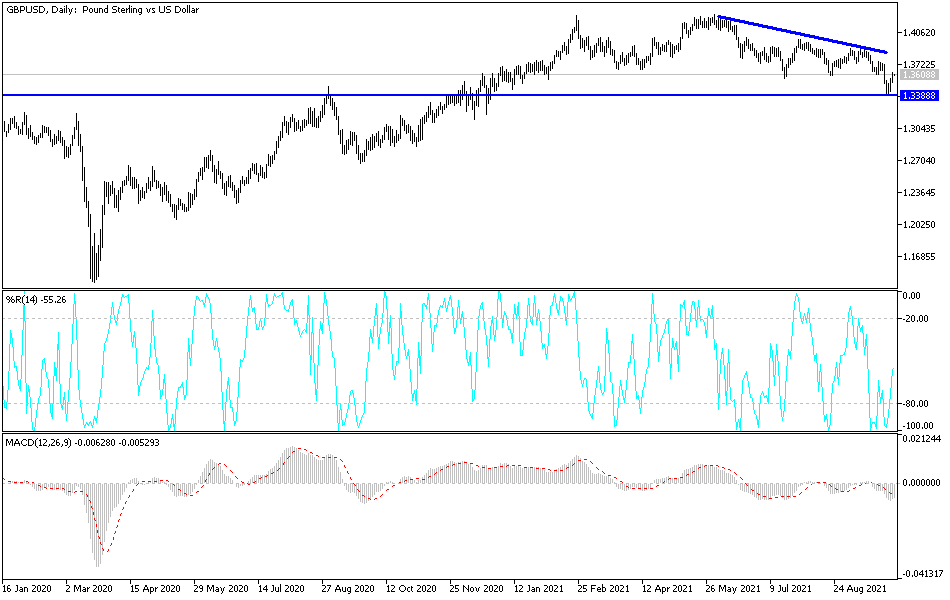

The British pound rallied significantly on Monday, but as you can see, we are pressing the previous support level sitting at roughly 1.36. It was the bottom of a descending triangle, so it is likely that the market is going to have a bit of “market memory” in that general vicinity, as it was so crucial.

It is also worth noting that the 200-day EMA sits at the 1.37 handle and is attracting the 50-day EMA to form the so-called “death cross.” In other words, this is a market that I think will continue to find sellers given enough time, but we have obviously seen a nice rally over the last couple of trading days. I think that the next few days will tell us as to where we are going longer term, and the jobs report on Friday we may very well be the actual catalyst to get this thing moving to the downside. Either way, I think you can probably count on quite a bit of noisy behavior, as the real rates in the bond market may start to offer enough value that people will be willing to go looking to the greenback.

To the upside, it is not until we break above the 1.37 handle on the daily close that it could kick off more buying, as there is a downtrend line as well just above there. If we were to break above the downtrend line and then eventually the 1.39 handle, the market would enter a longer-term “buy-and-hold” type of scenario. That being said, this is a market that has a lot of work to do before we get anywhere near there, so I am still looking for exhaustion that I can start selling into. We did get a little bit of that towards the end of the day but not enough to get be overly excited.

To the downside, the 1.35 level could be a target, and then the 1.34 level after that. Breaking that opens up the “trapdoor” for a move much lower, perhaps down to the 1.30 level. Obviously, we will have to see general US dollar strength across the board when it comes to the currency markets, as we generally see the greenback move in the same direction against almost everything.