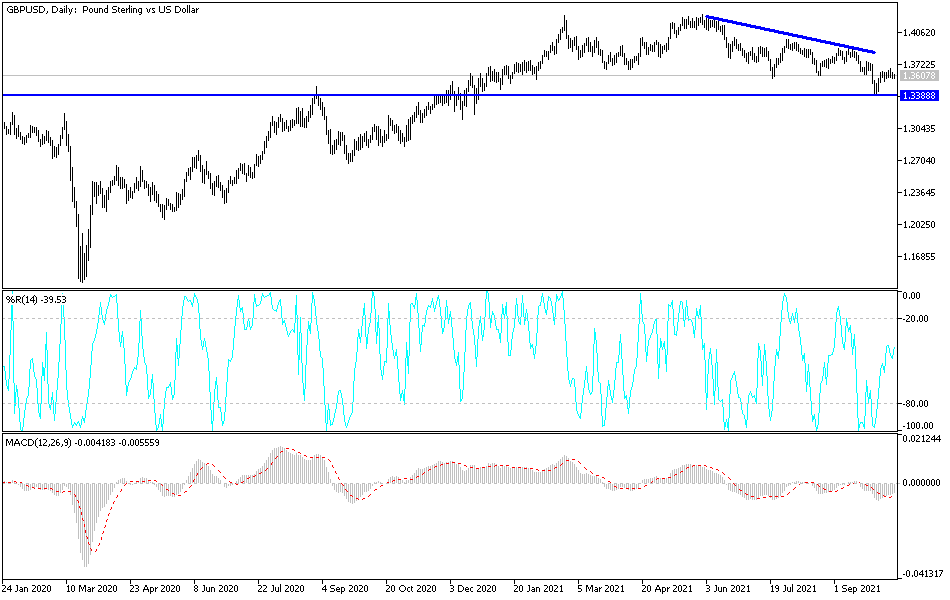

The British pound rallied during the early hours on Tuesday, but as you can see, has given back quite a bit of the gains to show signs of exhaustion. The shooting star-shaped candle does look as if we are going to break down a bit from here, and if we break down below the bottom of the candlestick for the day, then it is likely that we will go looking towards the 1.35 handle. On the other hand, the upside could see a move towards the 1.37 handle, but it is an area that has been rather resistive.

The 50-day EMA is starting to reach towards the 200-day EMA and breaking down below it. With that being the case, we are going to get the so-called “death cross”, as the market is likely to see further selling pressure due to the fact that the market pays close attention to these signals for longer-term trades. This is a market that I think is likely to continue going lower not only due to the death cross, but the fact that the market is struggling with the previous support level of the descending triangle. This is a simple breakdown and retest of a typical pattern.

Underneath, the 1.35 level is supportive and could make a nice target. If we break down below there, then it is likely that we will go towards the 1.34 handle, and breaking down below the 1.34 handle could send this market much lower. That could open up a bit of a “trapdoor” lower. Rallies continue to get sold into, and it is not until we break down below the previous downtrend line that I would even remotely consider buying this market. If we did break above there, then the 1.39 level would open up a potential move towards the 1.40 handle above. After that, then we could go looking towards 1.42 level as well.

In general, this is a market that I think will continue to hear a lot of noisy behavior, but it certainly looks as if it sees quite a bit of negativity, as the trading community is starting to worry that the Bank of England is going to make a huge mistake tightening monetary policy, as it is very possible that we are heading into a recession.