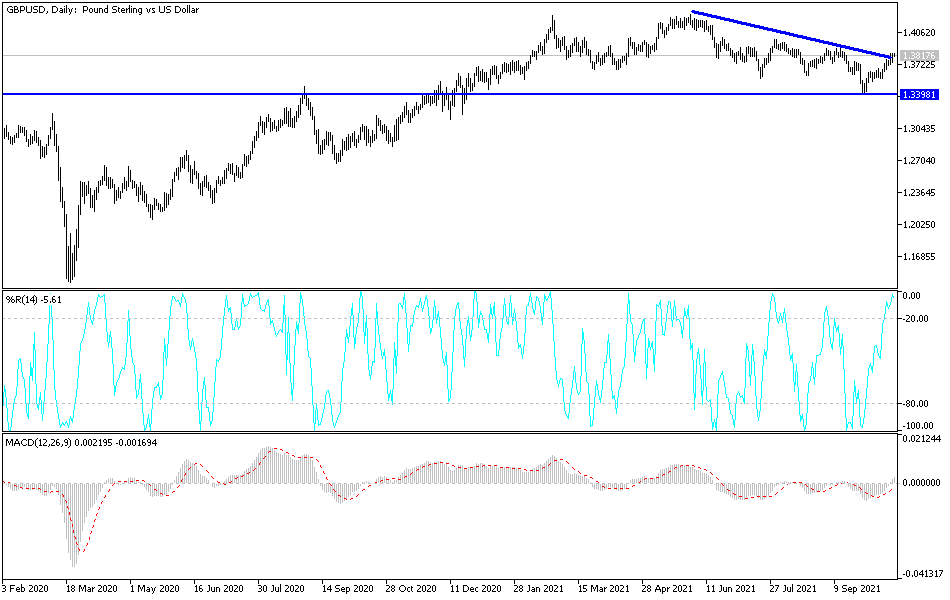

The British pound pulled back a bit on Wednesday to show signs of weakness and find buyers. The market has bounced from the previous trendline, and now shows as if it is ready to continue going higher. If that is going to be the case, then we are almost certainly going to challenge the 1.39 handle. By breaking above the 1.39 handle, then the market could very well go much higher, with a certain amount of interest paid to the 1.40 handle.

To the downside, the 1.37 handle is a significant support level, and as a result, if we were to break down below there it could change a lot of things. Keep in mind that both the 50-day and the 200-day EMA indicators are sitting there, and that probably will cause a certain amount of attention by itself. The 50-day EMA is already starting to turn higher, which suggests that we have more momentum coming our way and that pullbacks will be looked at as potential buying opportunities. The short-term charts will probably be used for interest, but it is clear that we have completely negated what could have been thought of as a fairly significant descending triangle. By doing so, that shows a complete reversal of fortune.

Looking at this chart, if we did break down below the 1.37 handle, it would be a significant reversal of what has been a very resilient market. Yes, we have gotten a bit overstretched, but it should also be noted that we gave back some of those gains early in the session on Wednesday and failed to stay down. The US dollar is losing strength against multiple currencies, including the Australian dollar, something that has a whole list of problems attached to it. The United Kingdom has the added bonus of the Bank of England getting ready to raise interest rates, so at this point in time it is likely that sterling will outperform any of its major competitors. The candlestick does suggest further strength, but I also recognize there is a lot of noise just above this general vicinity, so it may take a couple of attempts to actually make the breakout happen. That being said, if and when we do break out, it is likely that we will have an explosive move.