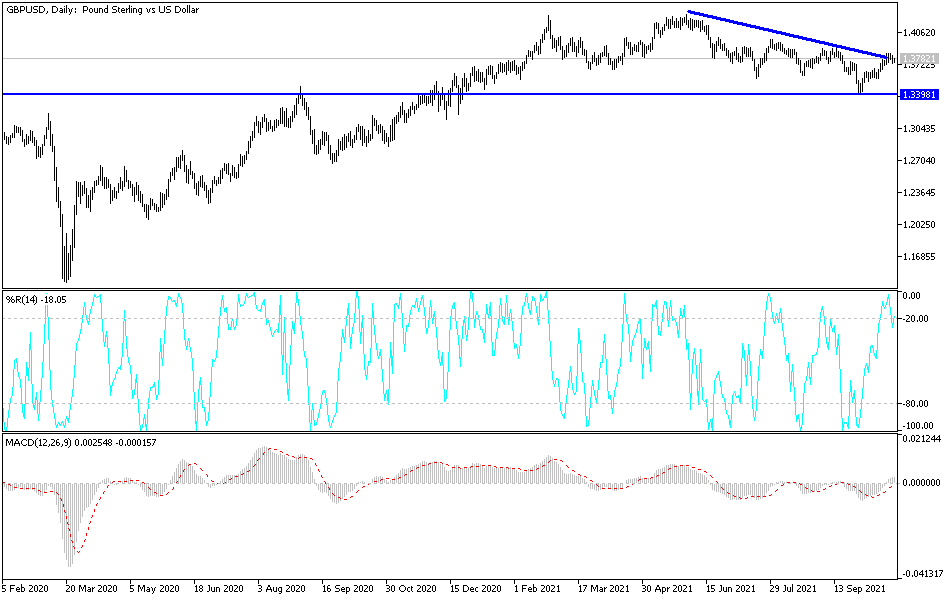

The British pound fell again on Friday, but still remains supported just below. The previous trendline is offering support, and the 50-day EMA sits below, and it looks as if we are getting ready to see it curl higher. With that being the case, the market is likely to continue seeing a lot of noisy behavior just underneath, especially as the 1.37 level has been important more than once. The 50-day EMA is sitting on top of the 200-day EMA as well, so I think it all comes together for a major support level.

The market breaking down below the 1.37 handle could send this market lower, perhaps reaching towards 1.36 level. If we do turn around and break down below the 1.36 handle, that could open up a bit of a “trapdoor” to much lower pricing. At that point, it would become a very negative trend, and I would be short of this pair. The market will move based upon the US dollar more than anything else, as the greenback continues to lose strength in general. That being said, the British pound has been a bit parabolic as of late, so this little bit of a pullback does make sense.

To the upside, if we can break above the 1.38 handle, then the market is likely to go higher, perhaps reaching towards the 1.39 level, and then eventually the 1.40 handle. The market going higher after the trend line break does make sense, but it is also a market that is going to be very noisy. The Bank of England is likely to raise interest rates, and that will help the idea of the British pound going higher in value. The market will be choppy regardless of what happens next, and as a result it is likely that you are better served having little positions and adding to them once things start to work out. I do believe that we will go higher, but if we do break down below the 1.36 handle, then I would become aggressively negative of this market, and would look for any opportunity to start adding to a short position, as another thing I will be paying attention to is whether or not the US dollar is strengthening against other markets.