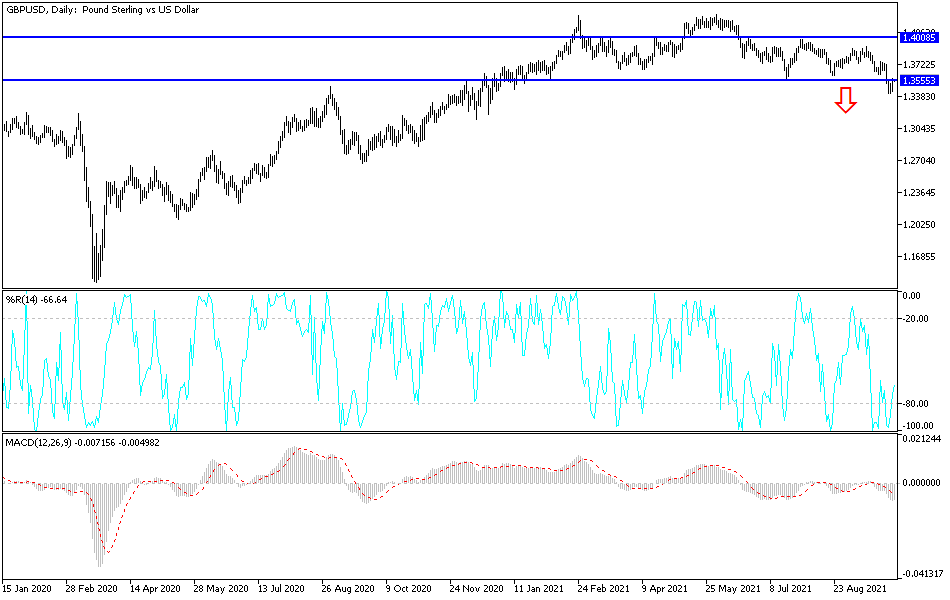

The British pound initially fell a bit on Friday but then turned around to show signs of strength as interest rates in the United States started to fall again. Whether or not this can continue is a completely different question, and it is worth noting that just above at the 1.36 handle is the bottom of a larger descending triangle that kicked off this move to begin with. Because of this, I think that we are probably going to see an opportunity to short this market sooner or later, on the first signs of exhaustion.

If we were to break above the 1.36 handle, then it is possible that we could go looking towards the 1.37 level, where the 200-day EMA currently sits. That being said, this move to the downside was pretty drastic, and a bit overdue. I believe that it is only a matter of time before we see this market continue the overall downtrend, perhaps reaching towards the lows of the week. If we break down below there, then it is likely that the British pound will fall apart, while it goes looking towards the 1.3250 handle, maybe even the 1.30 handle after that.

Keep in mind that the United Kingdom is struggling with fueling its own automobiles, so that in and of itself can give you an idea as to how broken the supply chain is currently. The concerns around the world with supply chain and inflation will continue to perhaps drive money into the bond market, especially if it starts to offer higher yields in general. That being the case, it does make a lot of sense that we would continue to go even lower. The markets will continue to be very volatile to say the least, but I do think it is only a matter of time before we have to have some type of decisive move. My suspicion is that earlier this week we at least started to see the beginning of this, and we are likely to see continuation sooner rather than later. Furthermore, we also have the so-called “death cross” getting ready to form as well, although that in and of itself is not necessarily a signal. The US dollar is like a wrecking ball for most markets, so pay close attention to what is going on here regardless of what you are trading.