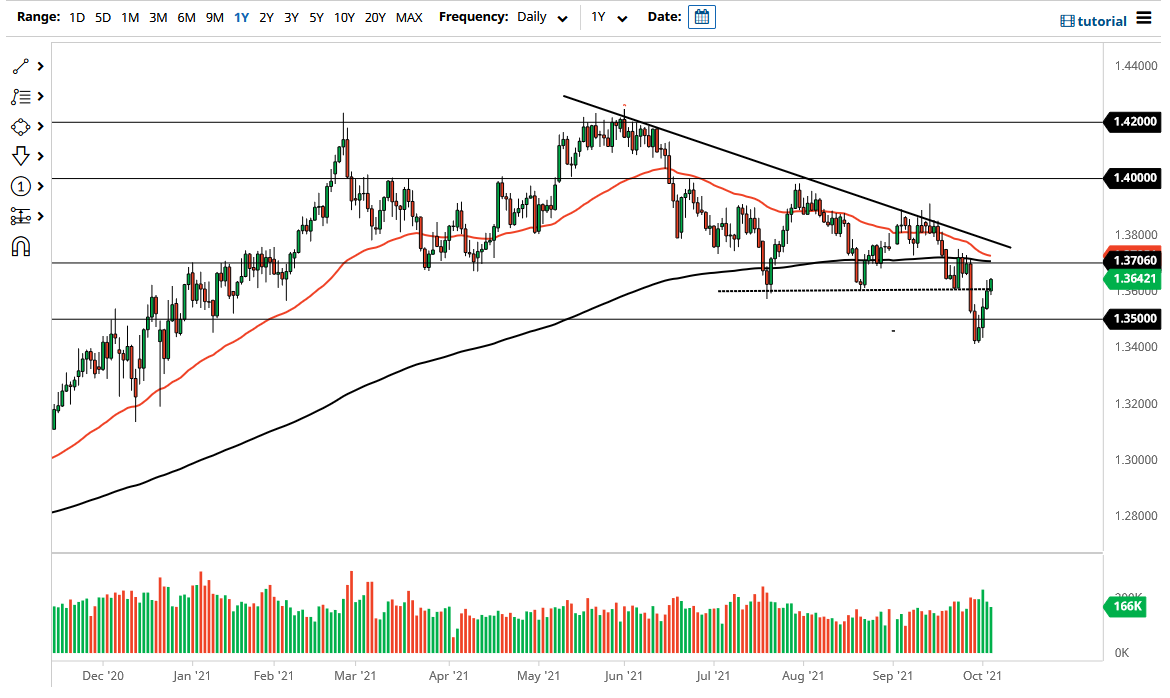

The British pound rallied significantly on Tuesday to reach towards the highs of the Monday session. At this point, at looks as if the British pound is going to be paying close attention to the 200-day EMA, which currently sits at the 1.37 handle. Furthermore, the 50-day EMA is getting ready to cross below there, kicking off the so-called “death cross.”

It should be noted that the market might be a bit overbought at this point, so it will be interesting to see what happens next. I think at this point in time, the market will continue to see a lot of noisy behavior, so I think you need to pay close attention to whether or not we run into some exhaustion. If we turn around and break down below the 1.36 handle, then it is likely that the British pound will continue to go lower, perhaps reaching towards the 1.35 handle, and then the most recent bounce. Breaking below the point of the most recent bounce could open up a significant amount of selling that could really start to kick this thing off to the downside.

It should be noted that we have seen a gradual decline in the value of the British pound for a while, and I think it is only a matter of time before we start to see another attempt to break down below at this point. At this juncture, it is very likely that we could see selling pressure sooner rather than later, and I certainly would not be chasing this market right now. After all, we got rather bullish at the drop of a hammer, so it will be interesting to see whether or not we can keep up the momentum going forward. I anticipate that somewhere between here and the 1.37 level we will find selling pressure that could send this much lower. Having said that, if we get above both the 200-day EMA and the 50-day EMA indicators, then we could see an attempt to get to the 1.39 level, but that would probably be something that goes right along with the overall attitude of the greenback worldwide. Because of this, you have to be cautious, but I do recognize that you can use the US Dollar Index in general.